Some of the products on this page come from partners who may compensate us when you click on their links or take specific actions. This helps us keep our content free. That said, our opinions are our own and based on independent analysis.

Cheap Business Insurance Quotes: Compare Online & Save in a Few Simple Steps

Building a business from scratch takes time, skill, effort and a financial commitment. One important step is to get your business insured and unfortunately, this can prove to be one of the more costlier steps in the process. Finding cheap business insurance might seem a bit frightening because you want quality insurance for your business. However, just because the policy is cheap doesn’t mean it doesn’t have the coverage you need. Get quotes from multiple providers and work with an independent agent to find the best rates for your business.

Key Takeaways

- Just because it is cheap doesn’t mean the insurance is bad.

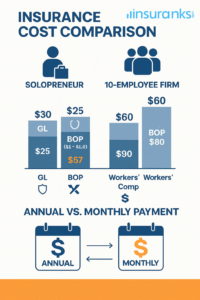

- General liability for a small business can cost as little as $25 a month.

- To find cheap business insurance ,work with an independent agent familiar with your industry.

- Compare business quotes to find the right insurance for the best price.

Cheap Business Insurance Companies: Comparison

Based on 2025 published data from their websites and online forums like Reddit, below are the cheapest business insurance companies for 2025.

How much is the cheapest business insurance?

Get insurance quotes from carriers with excellent customer reviews, AM Best, and BBB ratings.

| Company | Average Business Insurance Cost Per Month | Best for |

| CoverWallet | $27.50 | One-stop shop for affordable small business insurance online – from comparison to policy management! |

| Thimble | $17 | Home-based businesses and IT professionals |

| Next Insurance | $19 | Construction and fitness businesses, as well as millennials looking for fast, low-cost coverage online |

| Hiscox | $36.25 | Independent contractors looking for comprehensive coverage that is tailored to their industry at affordable rates |

| The Hartford | $85 | Workers Compensation |

| GEICO | $41-$78 | Commercial auto-rideshare |

| Progressive | $60-$85 | Commercial auto |

| Allstate | $37-$125+ | SMBs looking for tailored coverage |

| Travelers | $57-$220+ | Commercial property |

| State Farm | $26-$220+ | Best overall |

| Chubb | $35-$225+ | International businesses |

| USAA | $53-$162+ | Military Community |

| Farmers | $43-$150+ | Small business retail insurance |

| Embroker | From $52 | Startups |

Cheapest Business Insurance Companies Review

CoverWallet Business Insurance

| Insuranks rating | 9.3/10 |

| Best for | One-stop shop for affordable small business insurance online – from comparison to policy management |

| Year Founded | September 2015 and acquired by AON in 2020 |

| CEO | Inaki Beringuer (former) |

| Headquarters | 101 Avenue of the Americas 18th Floor New York, NY 10013 United States |

| Customer Support | (646) 844-9933 |

| AM Best Rating | A ( excellent) |

| BBB Rating | A+ |

| Number of Complaints | 158 |

Pros

- Online certificate of insurance

- Fast and easy to use

- Affiliated with the top carriers in the United States

- Very high customer satisfaction.

Cons

- Not an insurance company but an insurance broker.

CoverWallet isn’t an insurance company. But you can enjoy an easy online insurance application process. Therefore, finding cheap business insurance quotes through CoverWallet is simple.

In addition, through MyCoverWallet, customers can quickly pay, download proof of insurance, access policy documents, purchase optional coverages, and find the contact info of a carrier to make a claim.

Chubb Business Insurance

| Insuranks rating | 9.5/10 |

| Best for | International companies |

| Year Founded | 1882 |

| CEO | Evan G. Greenberg |

| Headquarters | 1133 6th Ave, New York, NY 10036, United States |

| Customer Support | 41-43-4567600 and chubbaccess@chubb.com |

| AM Best Rating | AA+ ( Superior) |

| BBB Rating | A- |

| Number of Complaints | 7 |

Pros

- Knowledgeable agents

- Offers insurance solutions for multinational businesses

- Customers can file a claim anytime and anywhere

- High customer ratings

- Covers businesses of all sizes

- Provides an excellent claims experience

Cons

- The online option is less friendly

Chubb is a great option for small, medium, and large businesses. It has numerous affordable commercial insurance policies that provide excellent protection depending on the type of products sold and the nature of business operations.

Thimble Business Insurance

| Insuranks rating | 9/10 |

| Best for | Home-based businesses and IT professionals |

| Year Founded | 2015 |

| CEO | Jay Bregman |

| Headquarters | New York City |

| Customer Support | hello@verifly.com |

| AM Best Rating | A+ ( excellent) |

| BBB Rating | A+ |

| Number of Complaints | 53 |

Pros

- Simple and fast insurance application

- Purchase instant short-term small business general liability insurance policies.

- It provides a great online experience

Cons

- Limited cover offers for businesses.

Thimble assures customers that getting insured will take less than an hour. Its policies generally apply to all risks small businesses face.

Next Business Insurance

| Insuranks rating | 9.6/10 |

| Best for | Construction and fitness businesses, as well as millennials looking for fast, low-cost coverage online |

| Year Founded | 2015 |

| CEO | Guy Goldstein |

| Headquarters | 75 California Ave, Palo Alto, CA 94304, United States |

| Customer Support | 1-855-222-5919 and support@nextinsurance.com |

| AM Best Rating | A- (excellent) |

| BBB Rating | A+ |

| Number of Complaints | 13 |

Pros

- Fast and easy online experience

- Live free certificates of insurance online

- No cancellation or administrative fees

- Many discounts

- Insures customers within 5 minutes

Cons

- Most of its claims are handled in-house or by third parties.

Next has the best commercial insurance coverage with discounts. Aside from discounts, Next also allows customers to enjoy getting a certificate of insurance and name additional insured without additional charges.

Hiscox Business Insurance

| Insuranks rating | 9.3/10 |

| Best for | Independent contractors looking for comprehensive coverage that’s tailored to their industry at affordable rates |

| Year Founded | 1901 |

| CEO | Aki Hussain |

| Headquarters | Pembroke Parish, Bermuda |

| Customer Support | 1-866-424-8508 and customer.relations@hiscox.com |

| AM Best Rating | A – excellent |

| BBB Rating | A- |

| Number of Complaints | 12 |

Pros

- Online quoting and purchase

- Global coverage

- Available in all 50 states

- 24/7 online claims filing

- 14-day money-back guarantee

Cons

- Complaints about filing claims

Among the best business insurance companies in the United States, Hiscox offers some of the most helpful property and casualty insurance products. A lot of customers find Hiscox’s certificate of insurance remarkable.

This is because customers can easily add their clients’ names or landlord names to it. In addition, Hiscox policyholders only need to provide their email address and policy number to get their certificate of insurance.

Get all the best quotes from leading providers in a click of a button!

The Hartford Business Insurance

| Insuranks rating | 9.5/10 |

| Best for | Workers Compensation |

| Year Founded | 1810 |

| CEO | Christopher J. Swift |

| Headquarters | 690 Asylum Avenue Hartford, CT 06155 |

| Customer Support | 855-440-1078, and customer complaint portal |

| AM Best Rating | A+ ( Superior) |

| BBB Rating | A+ |

| Number of Complaints | 163 |

Pros

- Comprehensive employee benefits insurance

- Easy online quoting

- 4.8 stars rating from 18,000 insured businesses

- Has partnerships with over 1 million healthcare providers in the United States

Cons

- Constant disputes with customers.

The Hartford offers low-cost commercial insurance. It offers solutions for small and big businesses and strives to maintain responsive customer service.

Geico Commercial Auto Insurance

| Insuranks rating | 5.1/10 |

| Best for | Commercial auto-rideshare |

| Year Founded | 1963 |

| CEO | Todd Combs |

| Headquarters | Chevy Chase, Maryland, United States |

| Customer Support | (800) 841-2964, and customer service portal |

| AM Best Rating | A++ ( Superior) |

| BBB Rating | A+ |

| Number of Complaints | 178 |

Pros

- Extremely strong financially with an A++ credit rating

- Provides general liability insurance with a per-occurrence limit starting at $300,000

- In partnership with Berkshire Hathaway for its workers’ comp insurance

Cons

- A significant number of complaints from customers

Geico excels as one of the best cheap commercial auto insurance companies. The rates are pretty lo,w and the customer service is top-notch.

State Farm Business Insurance

| Insuranks rating | 9/10 |

| Best for | Best overall |

| Year Founded | 1922 |

| CEO | Michael L. Tipsord |

| Headquarters | Bloomington, Illinois, United States |

| Customer Support | 800-782-8332, and the customer service portal |

| AM Best Rating | A++ ( Superior) |

| BBB Rating | B |

| Number of Complaints | 538 |

Pros

- High customer satisfaction ratings

- 24/7 phone and online claims service

- Efficient customer service

Cons

- Multiple complaints about unfairly denied claims

Insurance solutions State Farm has in store for small businesses are commercial auto, business owner’s policy, contractor’s policy, workers’ compensation, and fidelity and surety bonds.

Travelers Commercial Insurance

| Insuranks rating | 8.5/10 |

| Best for | Commercial property insurance |

| Year Founded | 1853 |

| CEO | Alan D. Schnitzer |

| Headquarters | New York, United States |

| Customer Support | 1-877-754-0481, and customer service portal |

| AM Best Rating | A++ ( Superior) |

| BBB Rating | A |

| Number of Complaints | 182 |

Pros

- Provides more than the usual minimum for its general liability insurance.

- Has tailored insurance solutions.

- Lower commercial auto insurance rates.

Cons

- Rates can sometimes become too expensive for their customers.

Travelers offers insurance solutions for small and big businesses in the construction, energy, finance, healthcare, manufacturing, real estate, technology, and transportation industries.

Progressive Commercial Insurance

| Insuranks rating | 8/10 |

| Best for | Commercial auto |

| Year Founded | 1937 |

| CEO | Tricia Griffith |

| Headquarters | Mayfield, Ohio, United States |

| Customer Support | 1-800-444-4487 and customer service portal |

| AM Best Rating | A+ ( Superior) |

| BBB Rating | D – |

| Number of Complaints | 1,313 |

Pros

- Offers customizable insurance covers.

- Easy filing of claims

Cons

- A significant number of complaints from customers

It protects against equipment breakdown, damaged stocks, and damage to business property.

Allstate Business Insurance

| Insuranks rating | 8/10 |

| Best for | SMBs looking for tailored coverage |

| Year Founded | 1931 |

| CEO | Thomas J. Wilson |

| Headquarters | Northfield Township, Illinois, United States |

| Customer Support | 1-800-255-7828, and the customer service portal |

| AM Best Rating | A+ (Superior) |

| BBB Rating | A+ |

| Number of Complaints | 908 |

Pros

- Good customer service

- A variety of property coverage options

- Commercial auto insurance with rental car coverage

- It has an app

Cons

- You must call to file a claim

The firm offers Property, Business interruption, Liability, and Equipment breakdown coverage.

USAA Business Insurance

| Insuranks rating | 8.5/10 |

| Best for | Military Community |

| Year Founded | 1922 |

| CEO | Wayne Peacock |

| Headquarters | San Antonio, Texas, United States |

| Customer Support | 001-210-498-2722, and customer service portal |

| AM Best Rating | A+ + (superior) |

| BBB Rating | A+ |

| Number of Complaints | 838 |

Pros

- Excellent customer ratings

- A variety of customizable coverage options

- Very cheap rates for customers

Cons

- Only available to US military personnel, veterans, and their direct families.

Its inexpensive business insurance options include General liability insurance, Workers’ compensation, Business owner’s policy, and Commercial auto.

Farmers Business Insurance

| Insuranks rating | 6/10 |

| Best for | Small business retail insurance |

| Year Founded | 1928 |

| CEO | Jeff Dailey |

| Headquarters | California, United States |

| Customer Support | 1-888-327-6335 and the customer service portal |

| AM Best Rating | BBB+ – good |

| BBB Rating | A- |

| Number of Complaints | 387 |

Pros

- Reliable customer service

Cons

- Many complaints in BBB

Farmers’ business insurance caters to the needs of different businesses regardless of industry, size, and speciality operations. It covers Property, Liability insurance, Crime coverage, Church insurance, education, charity, and non-profit organization insurance

Embroker Business Insurance

| Insuranks rating | 7.8/10 |

| Best for | Startups |

| Year Founded | 2015 |

| CEO | Matt Miller |

| Headquarters | San Francisco, California, United States |

| Customer Support | 844-436-2765 and success@embroker.com |

| AM Best Rating | A+ – Excellent |

| BBB Rating | A- |

| Number of Complaints | 150 |

Pros

- Quick customers service

- Customizable insurance policies

- 1st digital insurance carrier in the USA

Cons

- Limited insurance programs

- Not an insurance company, but a broker

What is Business Insurance?

Business insurance is a policy, or combination of policies, that protect a business. These policies will help a business in the face of unexpected financial, physical, and intellectual property damage or loss.

There are various types of insurance for businesses: Property, liability, and commercial auto insurance are the most common and cover the largest types of property.

- Commercial Property insurance: Covers reimbursement, repair, and replacement of business property.

- Liability insurance: Covers a business by answering the cost of lawsuits, such as attorney fees, filing fees, and compensation to the plaintiff. General liability is the most common type of liability insurance for a small business.

- Commercial auto insurance: Offers coverages such as commercial auto liability, bodily injury liability, property damage liability, personal injury PIP, uninsured/underinsured motorist, collision, and comprehensive coverage.

How Much Does Small Business Insurance Cost?

Different types of business policies cost different amounts because of the type of risk they cover.

Liability Insurance Cost

| Liability Insurance Coverages | Cost Per Month | Cost Per Year |

| General liability | $35.79 | $429.48 |

| Professional liability | $54 | $648 |

| Product liability | $0.30 per $100 revenue | $3.6 per $100 revenue |

| Premises liability | $24 | $288 |

| Employer’s liability | $98 | $1,176 |

| Directors and officers | $290.75 | $3,489 |

Commercial Auto Insurance Cost

| Commercial Auto Coverage | Cost per Month | Cost per Year |

| Commercial auto insurance: auto liability coverage | $95 | $1,140 |

| Gap | $32 | $388 |

| Umbrella | $25 | $397 |

| PIP/no-fault coverage | $165 | $1,656 |

| Uninsured/underinsured motorist | $14 | $172 |

| Comprehensive coverage | $17 | $204 |

Commercial Property Insurance Cost and Others

| Coverage | Cost per Month | Cost per Year |

| Commercial Property | $50 | $600 |

| Business Interruption | $120 | $1,400 |

| Inland Marine | $18 | $218 |

| Ocean Marine | 0.1% – 2.5% of cargo value | 0.1% – 2.5% of cargo value |

We can also determine the pricing of business insurance based on the business organization – limited liability corporations, sole proprietorships, partnerships, and corporations. The cost of business insurance for each is:

- LLC insurance costs $47.40 a month or $568.80 a year

- Sole proprietorships can get insurance for as low as $39.58 a month or $474.96 a year

- Partnerships and corporations pay $53 monthly or $636 annually for their insurance policies

Get all the best quotes from leading providers in a click of a button!

How to Save Money on Business Insurance?

When you’re looking to find cheap business insurance, these are steps you can take to make sure you are getting the right insurance at an affordable price for your business.

- Review your insurance needs. Meet with a local agent who understands your type of business and review what type of business insurance your company needs. As an agent, I regularly receive phone calls from individuals who reach out because their current agent cannot answer simple questions about the type of insurance their business needs.

- Compare cheap business quotes. Once you have a solid idea of what type of insurance you need, go ahead and gather at least three quotes from different providers. There is a lot of value in comparing quotes because different insurance companies have different underwriting procedures and different industries they want to insure and not insure. If your business is an industry that one out of three wants to insure, then you’ll discover that two will have high quotes and one will have a cheap quote.

- Explore bundling options. Most insurance companies have some form of a bundle discount. It might be a multiline discount, meaning the more policies you purchase exclusively from them, the cheaper your rates will be. Or, it could be a policy that comes as a bundle, like a Business Owner’s Policy. Either way, this is a great way to save money on your business insurance.

- Work with an independent agent or broker. The advantage of an independent agent is that they can provide you with multiple quotes from different carriers. Importantly, don’t let them just get back to you with the cheapest quote. Ask them to share all of the quotes they have received.

- Have appropriate coverage limits. While it may not make much of an impact on your overall premium, not carrying too high a limit is another way to save. Some businesses, say a photographer, do not need as high of liability limits as a parachute packer.

- Adjust your deductible. The deductible is the amount of money you agree to pay out of pocket if there is a claim. Lowering this will increase your premium, and raising it will lower your premium.

- Ask for discounts. Some insurance companies have a host of different discounts, and depending on your business, you may be eligible for additional ones. Others have none, and that is okay. But if you don’t ask, then you may miss out on a way to save.

- Control what you can control. One of the number one factors in all premium calculations is your claims history. Make sure your business is doing everything it can to minimize risk so that you are able to have a clean claims history. Not only will this help keep your premium under control, but over time, you should see it begin to decrease.

By following these steps, you can save your business some money with cheap business insurance that doesn’t sacrifice quality.

Cheap Business Insurance: What Others Are Saying

I surveyed online forums to see what business owners had to say about finding cheap business insurance.

Redditors offer first-hand advice:

“For a sole proprietor in Virginia… expect GL between $400 and $1,000 annually.”

A TaskRabbit user shared:

“I just got my NEXT quote: $134/month… remove tools coverage = $93/month.”

These voices highlight the importance of quoting multiple providers, customizing coverage, and avoiding unnecessary add-ons.

Final Quote

At the end of the day, business insurance isn’t just about finding the cheapest price; it’s about finding the right protection at a price that fits your budget. Whether you’re a solopreneur or managing a growing team, comparing quotes, bundling smartly, and reviewing coverage yearly can save hundreds without sacrificing peace of mind. Don’t settle for the first number you see, shop around, ask the right questions, and get a policy that truly protects what you’re building.