Some of the products on this page come from partners who may compensate us when you click on their links or take specific actions. This helps us keep our content free. That said, our opinions are our own and based on independent analysis.

Whether you’re selling fresh produce, baked goods, or handcrafted items, operating at a farmers market exposes your business to unique risks. From product liability claims to trip-and-fall injuries at your booth, the right insurance policy can protect your livelihood and give you peace of mind as you grow.

In this guide, we’ll explore everything you need to know about farmers market insurance in 2025: what it covers, how much it costs, which providers are the most vendor-friendly, and how to compare quotes online. Whether you’re a weekend hobbyist or running a full-time business, this guide is built for you.

Key Takeaways

- Most farmers’ market insurance policies start at $20–$30/month for basic general liability.

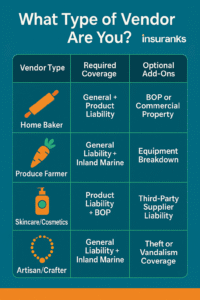

- Food vendors, artisans, and skincare sellers may all require different coverage types.

- Many markets require proof of liability insurance before allowing you to sell.

- Inland marine and product liability coverage are must-haves for mobile operations.

What Is Farmers Market Insurance and Why Do You Need It?

Farmers market insurance is a type of business insurance designed to protect vendors selling goods in open-air and community-based market settings. Coverage is designed to safeguard vendors against risks such as liability claims, theft, damage to inventory, and accidents involving customers or equipment.

Consider this scenario: a child trips over your table leg and breaks an arm. Without liability insurance, you’re financially responsible for their medical costs and any resulting legal action. Or maybe a customer alleges that your homemade jam caused food poisoning. Even if the claim is false, you’re still on the hook for legal defense. That’s where insurance steps in. It protects you from the financial fallout of unexpected claims.

What Types of Insurance Do Farmers Market Vendors Need?

Different types of vendors face different risks. While a baker may be more concerned with product liability, a jewelry maker might need protection against theft. Here’s a breakdown of core policies every vendor should consider:

General Liability Insurance

This is the most common and essential coverage for any farmer’s market vendor. It protects against third-party bodily injury and property damage. Markets often require proof of this before allowing vendors to set up.

Example: A customer trips over a loose tablecloth at your booth and sprains their ankle. Liability insurance covers medical costs and any legal defense

Farmers Market Public Liability Insurance

Some businesses in farmers’ markets decide to get a less comprehensive type of liability policy called public liability insurance.

Public liability insurance is a stand-alone liability policy that takes care of third-party personal injury claims and property damage claims against your business.

Please note that general liability insurance and public liability insurance aren’t the same. General liability insurance has a wider scope because it will take care of personal injuries, property damage, advertising injuries, and liability to rented premises as well. On the other hand, public liability insurance only covers personal injuries or property damage.

Product Liability Insurance

If you sell anything consumable, like baked goods, preserves, or skincare products, then product liability is crucial. It protects you if a customer claims your product caused harm.

Example: Someone claims your lavender lotion caused a severe rash. Product liability insurance can cover legal fees and settlements.

Inland Marine Insurance

Despite its name, this coverage protects mobile business equipment and is perfect for farmers market sellers transporting tents, tables, and inventory.

Example: Your booth tent is damaged in a windstorm or stolen while loading into your truck. Inland marine insurance covers replacement costs.

Business Owner’s Policy (BOP)

A BOP bundles general liability, property insurance, and business interruption coverage at a discounted rate, which is ideal for vendors with more permanent setups or those operating year-round.

Example: Your home bakery catches fire, halting business. A BOP may help cover cleanup, equipment replacement, and lost income.

Depending on the size and scope of your operation, you may only need temporary insurance. Some carriers, like Thimble, offer short-term liability by the hour, day, week, or even month. The policy is designed to the meet the minimum liability requirements for your booth to be part of the farmer's market while not needing to pay for insurance year-round.Something to Consider

Market-Specific Coverage Scenarios

To better understand your insurance needs, here are some real-world vendor profiles:

1. Home Bakery Seller

You sell cookies, muffins, and seasonal pies made in a home kitchen. You’ll need general liability, product liability, and possibly a commercial kitchen rider if your home policy excludes business use.

2. Organic Produce Farmer

You grow and sell vegetables at multiple weekly markets. General liability, product liability, and inland marine coverage (for transporting displays and perishables) are essential.

3. Handmade Soap and Lotion Seller

Your products contain essential oils that could trigger allergic reactions. Product liability is non-negotiable. You may also need coverage for third-party suppliers and bottling processes.

4. Jewelry Artisan

While not selling consumables, your booth setup could pose risks. General liability plus inland marine coverage for transporting inventory is a smart choice.

Regulatory Requirements by State

Insurance requirements can vary depending on local laws and the farmers market’s own policies. Here are a few examples from across the U.S.:

- California: Most counties require $1M general liability coverage for any vendor selling food, plus product liability.

- New York: Event organizers often request vendors name the market as an additional insured.

- Ohio: Food handlers must provide proof of safe kitchen practices—often tied to liability policies.

- Texas: Mobile vendors must maintain inland marine coverage if transporting equipment or perishables.

- Florida: High humidity and theft risks mean vendors are encouraged to carry inland marine or BOP coverage.

Always check with your local market coordinator for specific insurance documentation before registering.

Get all the best quotes from leading providers in a click of a button!

Farmers Market Insurance Cost Comparison

Farmers market insurance remains one of the most affordable types of business insurance, especially for low-risk vendors. Here’s what you can expect to pay:

| Cost per Month | Cost per Year | |

|---|---|---|

| General liability insurance for farmers’ market vendors | $35 | $420 |

| General liability insurance for farmers’ market artisans | $38 | $456 |

| General liability insurance for food trucks at farmers’ markets | $41 | $492 |

Keep in mind that these averages come from nationwide surveys. Your costs may vary based on location, business history, revenue, and other risk factors.

Here are average farmers’ market vendor insurance quotes from top-rated providers based on independent reviews and customer feedback:

| Cost per Month | Cost per Year | Best for | |

|---|---|---|---|

| CoverWallet | $38 | $456 | Farmers market insurance online quotes comparison |

| Thimble | $43 | $516 | Short-term farmers market insurance with liquor liability coverage |

| NEXT | $45 | $540 | Farmers market insurance you can avail regardless of location |

Best Farmers Market Insurance Companies

The best farmers market insurance companies offer limits to meet host requirements, quick and accessible COIs and the option to purchase short-term liability coverage.

CoverWallet Insurance

Pros

- Buy insurance online

- Pay premiums online

- Cancel a policy anytime

- Has live insurance agents ready to help you find the best coverage

Cons

- Policy cancellation takes 30 days at most

CoverWallet is an insurance broker with an online quotes comparison platform you can use to find the companies that offer tailored farmers market insurance for different types of small businesses. Getting and comparing quotes is easy. All you have to do is provide your location, tell the platform the type of farmers’ market business you’re running, and everything is set. Note that CoverWallet’s platform shows the latest features and pricing of the farmer’s market insurance quotes from different carriers.

Best for: Farmers market insurance online quotes comparison

Average cost: $38 per month

Our rating: 10/10

Thimble Farmers Market Insurance

Pros

- Get covered in less than 5 minutes

- Provides an instant ACORD certificate of insurance

- Choose not to have a deductible

- Only have coverage for hours, days, weeks, or months

- Insure yourself without talking to an agent

Cons

- Doesn’t have in-house experts who can advise you about business risk management, which helps to reduce premium costs

Thimble provides you with general liability coverage with its farmers market insurance. You can choose to have protection for only hours, days, weeks, or months. You’ll find this useful if you’re a home-based business that occasionally operates in any farmers’ markets. This company offers additional liquor liability insurance if your business sells liquor or alcoholic beverages.

Just like CoverWallet, Thimble insures you instantly online. There’s no need to talk with an insurance agent because the company’s insurance application platform simplifies everything for you – just provide a zip code, number of employees, revenue, the policy to get, length of coverage, and all is set.

Best for: Short-term farmers market insurance with liquor liability coverage

Average cost: $43 per month

Our rating: 9/10

NEXT Farmer’s Market Insurance

Pros

- Get a quote online

- Save up to 10% when buying two or more policies

- Offers a live certificate of insurance you can send as a text message, email, or social media post

- Has an easy-to-navigate mobile app where you can file a claim, track a claim, and manage insurance online

- Available in all 50 states

Cons

- Doesn’t cover customers with a poor claims history

NEXT’s farmers market insurance has general liability insurance, commercial auto insurance, commercial property insurance, and workers’ compensation insurance. Work with this company if you want your business insurance policies to offer the minimum amount of coverage available. Also, NEXT is a wonderful option if you want a company that allows you to seamlessly send certificates of insurance in different media.

Best for: Farmers market insurance you can avail regardless of location

Average cost: $45 per month

Our rating: 10/10

How to Get Cheap Farmers Market Insurance?

The best way to get the lowest rate is to compare quotes from multiple insurers, who often compete to win your business.

To find affordable farmers’ market insurance now, click the ‘Get Quotes’ button below, complete the questionnaire, and compare customized quotes and coverage options online from top-rated providers.

Tips for Reducing Farmers Market Insurance Costs

- Bundle policies through a BOP to save 10–20% annually

- Ask for multi-event discounts if attending multiple markets with the same organizer

- Raise your deductible if you have cash reserves to self-insure smaller claims

Take a safety course to qualify for vendor-specific training discounts

Farmers' market organizers will request you to purchase general liability insurance before granting permission to sell. General liability insurance allows you to add the management of the farmer’s market as an additional insured. This is why it's a requirement. Yes. Most insurance carriers allow this, and most markets require it. It protects them if a claim is made involving your booth. Usually not. Most homeowners' or renters' policies exclude business activity. You’ll need a separate business insurance policy. A $1 million general liability policy is the norm, with some requiring $2 million aggregate. Food vendors should also carry product liability. In most cases, yes. Especially if you're selling food, skincare, or handmade items. Many markets won’t let you register without proof of general liability coverage.

Is General Liability Insurance Required?

Can I list the market as an additional insured?

Does my homeowner’s policy cover farmers market sales?

How much insurance do I need?

Do I need insurance to sell at a farmers market?

Don’t Let One Bad Day Ruin Your Season

Farmers’ markets can be profitable, community-driven platforms to grow your business. But one claim, from a toppled display or tainted cupcake, can derail everything. The right insurance protects your passion and keeps you selling confidently, rain or shine. Don’t leave it to chance: cover your booth, your product, and your peace of mind.

Also read: