Some of the products on this page come from partners who may compensate us when you click on their links or take specific actions. This helps us keep our content free. That said, our opinions are our own and based on independent analysis.

Embed this calculator on your site

Copy and paste the HTML code below into your website.

Whether you’re whipping up cupcakes in your home kitchen or running a bustling storefront bakery, insurance isn’t a recommendation; it’s essential. Baking may seem like a wholesome pursuit, but it comes with serious business risks: allergic reactions, property damage, equipment failure, and even customer injury. That’s where bakery insurance comes in.

In this guide, we’ll walk you through everything you need to know about bakery insurance in 2025, from policy types and costs to the top providers and real-world claims examples. Whether you’re an independent home baker or operating multiple locations, we’ll help you find coverage that keeps your business safe.

Key Takeaways

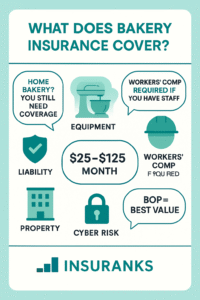

- Bakery insurance typically costs $25–$125/month, depending on business size and coverage.

- Most small bakeries start with a Business Owner’s Policy (BOP) that includes liability, property, and loss of income.

- Home baking insurance is essential if you sell baked goods from a residential kitchen.

- Policies like product liability, equipment breakdown, and cyber insurance can fill in gaps.

Why Bakery Insurance Is Non-Negotiable

Insurance protects your bakery from the unexpected. It’s not just about covering fire damage or break-ins (although it helps for those situations), it’s about surviving the real risks that bakers face every day. One poorly labeled cookie could lead to a six-figure lawsuit. A power outage that shuts down your refrigeration could spoil thousands of dollars in inventory. Even something as basic as a customer slipping on a wet floor can become a major liability.

Bakery insurance and home baking business insurance are very similar to insuring other small businesses, such as restaurants and caterers. Although it may seem trivial or unnecessary, purchasing business insurance for home bakers or a regular bakery is an essential part of running a business.

In short, if you’re selling food, you’re exposed. Bakery insurance is how you protect your business, your income, and your peace of mind.

Types of Bakery Insurance Coverage You Might Need

General Liability Insurance

This foundational coverage protects your business if someone is injured on your premises or their property is damaged due to your operations. It covers legal fees, medical bills, and settlements. Whether a customer trips in your shop or gets sick after eating your brownies, general liability steps in.

Product Liability Insurance

This is crucial for any food business. If your product causes illness or injury, like an allergic reaction or food poisoning, you can be held responsible. Product liability insurance is often bundled with general liability or included in a BOP. Check with your agent to make sure you have it, and if not, how to acquire it.

Commercial Property Insurance

Covers your physical assets: ovens, mixers, refrigerators, inventory, and even the structure itself. If your bakery is damaged by fire, theft, or storms, property insurance helps you repair or replace what’s lost.

Business Owner’s Policy (BOP)

A BOP is a popular bundle for bakeries. It combines general liability and property insurance and often includes business interruption coverage, which reimburses you for lost income if you’re forced to close temporarily due to a covered loss.

Equipment Breakdown Coverage

Modern bakeries rely on commercial equipment. If your industrial mixer, proofing cabinet, or ovens break down due to mechanical failure, this policy helps cover the cost of repairs or replacements.

Workers’ Compensation

If you have employees, this is required by law. Every state except for Texas and South Dakota requires a business to offer workers’ compensation insurance. That’s because it covers medical bills and lost wages if a team member gets injured on the job, like burning themselves while handling hot trays or slipping on a wet floor.

Cyber Insurance

If you take online orders or store customer information digitally, cyber insurance protects against hacks, data breaches, and ransomware attacks.

Commercial Auto Insurance

Delivering orders? If you or your employees use a vehicle for business, even occasionally, you’ll need this to cover accidents and liability.

Does a Home-Based Business Endorsement Cover Your Bakery?

If you run your bakery from home, you might think adding a home-based business endorsement to your homeowners insurance is enough to protect you. While these endorsements can extend limited coverage, often around $2,500 to $5,000, for business property like baking tools or supplies stored at home, they rarely cover key risks like product liability if someone gets sick from your baked goods, or business interruption if an incident shuts down your kitchen. They also typically exclude any claims arising from your premises, like sales at farmers’ markets or local events. If you sell more than a few thousand dollars’ worth of baked goods per year or offer custom orders, you’ll likely need a dedicated home-based business insurance policy or a commercial general liability policy. These options provide broader coverage for things like lawsuits, property loss, and other risks unique to selling food products, ensuring your home bakery doesn’t jeopardize your finances.

Real-World Claims from Bakers

- A home baker in Texas was sued after a customer with a nut allergy reacted to trace amounts of almond flour. Product liability covered the $40,000 claim.

- A New York storefront bakery lost $12,000 in inventory when the walk-in fridge broke down overnight. Equipment breakdown insurance reimbursed the cost.

- In Michigan, a baker’s assistant slipped on a wet floor and fractured their arm. Workers’ comp covered medical bills and wages during recovery.

These aren’t hypothetical scenarios. These are the everyday risks bakers face, and the exact moments when insurance saves your business.

Get all the best quotes from leading providers in a click of a button!

Bakery Insurance Cost: How Much is Insurance for a Bakery?

If you’re wondering how much bakery insurance costs, you’ll be glad to know it’s generally quite affordable. On average, bakeries pay around $420 per year, or roughly $35 per month, for a general liability policy with $1 million in coverage. This type of insurance helps protect you if someone is injured by your products or experiences property damage related to your business.

For home bakers, insurance can often be even less expensive. Since home-based bakeries typically operate in smaller spaces and have lower sales volumes, they present fewer risks for insurers. Many home bakers also deliver their products instead of inviting customers into their homes, which further reduces liability exposure. As a result, some home bakers pay as little as $25 per month, or about $300 per year, for $1 million in general liability coverage.

Keep in mind these are average costs, and your premium may vary depending on factors like the size of your bakery, the number of customers you serve, your location, and your annual revenue. Fortunately, most new or small-scale bakeries, including home-based ones, find insurance costs manageable and well worth the peace of mind.

Below is a table comparing pricing from some of the best bakery insurance providers for $1 million in general liability coverage:

| Cost per Month | Cost per Year | Best for | |

|---|---|---|---|

| NEXT | $25 | $300 | Best overall, Fastest general liability insurance for bakeries |

| CoverWallet | $27 | $324 | Bakery insurance online quotes comparison |

| Tivly® | $28 | $336 | Comparing bakery insurance quotes over the phone |

| Thimble | $28.52 | $342 | Short-term general liability insurance for home bakers and BOP for bakeries |

| Hiscox | $35 | $420 | Bakery insurance with automatic policy renewal |

A great way to save money is by comparing quotes online. Here’s how to do it:

- Go to a comparison tool like CoverWallet.

- Enter your business details: name, location, revenue, and type of baking.

- Select coverage options: general liability, BOP, etc.

- Review quotes from multiple providers.

- Pick a policy or schedule a call with a rep.

How to Purchase Bakery Business Insurance?

Now that we’ve answered some of your more pressing questions, here’s a quick breakdown of the steps you need to take to purchase bakery insurance or home baking business insurance.

Step 1: Gather Your Business Paperwork

First, gather all of the necessary business paperwork that proves the legitimacy of your baking business. You’ll also need to know the square footage of your workspace. If you have a home bakery, then you’ll need to measure the area of your kitchen, storage, and preparation areas. If you rent a space, then you’ll need to obtain the square footage from the landlord

Step 2: Compare Bakery Insurance Quotes

If you want to get a good deal, it’s always best to compare baking insurance companies and providers. You can easily do this online through this page by hitting the get quotes button and following through with the smooth process. You will then receive free bakery insurance quotes online from the very best bakery and home baking insurance companies at competitive rates.

Step 3: Determine Your Coverage Types, Limits, and Deductibles, then Complete Your Purchase

Once you have a list of quotes and your top choices, figure out which one is best for your needs in terms of company, coverage, and budget, and you will be able to complete your purchase fully online through our partners. You’ll have to determine your coverage types, limits, and deductibles ahead of your purchase.

Best Bakery Insurance Companies

Many insurance companies offer coverage for bakeries. Given the many choices, you might get confused about which to get insurance from. To solve that problem, here’s a review mentioning the pros, cons, and pricing of the best bakery insurance companies for $1 million general liability coverage.

NEXT Bakery Insurance

Pros

- Best overall

- Get an online proof of insurance and send as a text message, email, or social media post

- Fastest general liability insurance for bakeries

- Great customer service and reputation

- Issues an online proof of insurance instantly

- Outstanding value for money

- Bundle two or more insurance policies and get a 10% discount

Cons

- Couldn’t find any

NEXT’s bakery insurance includes general liability, commercial auto, workers’ compensation, and commercial property insurance policies. When buying insurance from this company, consider bundling two or more policies in a BOP so that you’ll get a 10% discount on premiums.

Best for: Best overall; Fastest general liability insurance for bakeries

Average cost: $25 per month

Our rating: 10/10

CoverWallet Bakery Insurance

Pros

- Compare bakery insurance quotes online

- Cancel a policy anytime

- Easy policy management with the CoverWallet website or app

Cons

- Not an insurance company but a broker selling the quotes of its partners

CoverWallet has an online quotes comparison platform where you can compare the offers and pricing of different carriers covering bakeries. Even though it’s just an insurance broker, CoverWallet has tailored plans for bakeries as it customizes the quotes of its partners. You have four insurance options with CoverWallet – general liability only, general liability and commercial property, business owner’s policy with workers compensation, and a custom plan.

Go for CoverWallet because its insurance process is mostly digitized. Pay premiums via the CoverWallet website or MyCoverWallet app. Talk with agents online. Also, you can get a certificate of insurance by computer or phone.

Best for: Bakery insurance online quotes comparison

Average cost: $27 per month

Our rating: 10/10

Tivly® Bakery Insurance

Pros

- A partner of reputable insurance companies

- Call and compare bakery insurance quotes over the phone

- Responsive customer service

Cons

- You need to call to get a quote

Tivly® (formerly CommercialInsurance.Net) sells general liability, commercial property, workers’ compensation, business owner’s policy and other insurance products for bakeries. This company can take you to partners if it can’t provide coverage. Call Tivly® now and compare bakery insurance quotes over the phone.

Best for: Comparing bakery insurance quotes over the phone

Average cost: $28 per month

Our rating: 10/10

Hiscox Bakery Insurance

Pros

- Automatic policy renewal

- 14-day money back guarantee

- Easy online insurance application

- Worldwide coverage

Cons

- Poor customer reviews

Hiscox sells general liability insurance, business owner’s policy and cyber liability insurance for bakeries. Your insurance from this company automatically renews per year. That said, you’re sure to get covered all the time if you stay with Hiscox. As a new policyholder, there’s no worries trying Hiscox out because it gives a 14-day money back guarantee should you decide to cancel your coverage.

Best for: Bakery insurance with automatic policy renewal

Average cost: $35 per month

Our rating: 9/10

Thimble Bakery Insurance

Pros

- Short-term general liability for home bakers

- Cheap BOP for bakeries

- Get insured online

Cons

- Customer service takes long to respond sometimes

Thimble sells its bakery insurance as a business owner’s policy – a combination of commercial property insurance and general liability insurance. But this company doesn’t stop the protection for your business with these two policies. Thimble’s BOP for bakers also includes business interruption insurance and equipment breakdown insurance.

You might like Thimble because it allows you not to have any deductible on your insurance policies. Furthermore, you can purchase insurance and proof of insurance online. Another thing, if you’re a home baker, Thimble can cover you with short-term general liability coverage that lasts for hours, days, weeks, or months.

Best for: Short-term general liability insurance for home bakers and BOP for bakeries

Average cost: $28.52 per month

Our rating: 9/10

Get all the best quotes from leading providers in a click of a button!

Do You Need Insurance to Sell Baked Goods From Home?

Although it may not be a legal requirement to have insurance for baking from home, it's a smart decision to make. A simple home-based bakery insurance policy can protect your business against unforeseen events such as a fire, lost product, or one of your customers getting sick or injured from your food. Without it, you may end up with big unexpected financial losses due to such occurrences.

Do I Need a Business License to Purchase General Liability Insurance for my Bakery?

Yes, in order to purchase a bakery insurance policy, you'll need to have a legitimate licensed business . This means that you'll need to have your IRS-issued EIN number , and possibly your articles of incorporation, or local city business license/retail license, handy to present to your insurance provider.

What's the most important coverage for a bakery?

At a minimum, general liability and property. A BOP combines both and is often the most cost-effective.

Do You Need Insurance to Sell Baked Goods From Home?

Although it may not be a legal requirement to have insurance for baking from home, it's a smart decision to make. A simple home-based bakery insurance policy can protect your business against unforeseen events such as a fire, lost product, or one of your customers getting sick or injured from your food. Without it, you may end up with big unexpected financial losses due to such occurrences.

Do I Need a Business License to Purchase General Liability Insurance for my Bakery?

Yes, in order to purchase a bakery insurance policy, you'll need to have a legitimate licensed business . This means that you'll need to have your IRS-issued EIN number , and possibly your articles of incorporation, or local city business license/retail license, handy to present to your insurance provider.

What's the most important coverage for a bakery?

At a minimum, general liability and property. A BOP combines both and is often the most cost-effective.

Don’t Let a Burnt Batch Burn Your Business

You’ve worked hard to build your bakery. One accident, one customer injury, one ruined inventory run shouldn’t be the thing that ruins it. Whether you’re baking from home or managing staff in a storefront, protect your passion and your livelihood with the right coverage.

Read more: Food Liability Insurance

sources: