Some of the products on this page come from partners who may compensate us when you click on their links or take specific actions. This helps us keep our content free. That said, our opinions are our own and based on independent analysis.

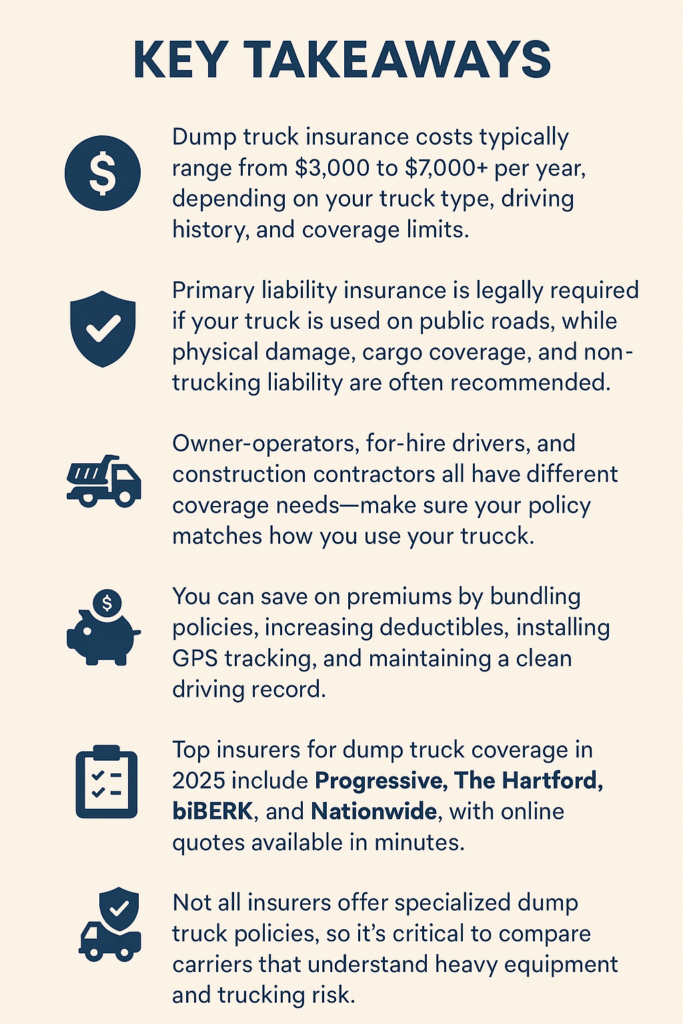

Owning and operating dump trucks comes with big responsibility and even bigger risks. Whether you’re running a construction fleet, hauling debris for municipalities, or managing a commercial landscaping business, your trucks represent both a significant investment and potential liability. That’s where dump truck insurance comes in. It’s more than a legal requirement; it’s a financial safety net that protects your vehicles, your team, your customers, and your bottom line.

In this guide, we’ll cover everything you need to know about dump truck insurance in 2025, from what’s included in a policy to how much you should expect to pay. We’ll also explain how to save money, compare quotes, and choose the right provider, plus we’ll take a close look at additional policies you may need, like workers’ comp, fleet coverage, and more.

When you’re working with heavy machinery like skid steers or dump trucks, it’s often necessary to have liability coverage, at the very least. In this guide, we’re going to cover everything you need to know about insuring these vehicles, including how to get cheap dump truck insurance and garbage truck insurance.

What is Commercial Dump Truck Insurance and Who Needs It?

If you operate a dump truck for commercial purposes, and let’s be honest, that’s nearly always the case, then dump truck insurance is non-negotiable. For starters, auto insurance is required by the state government in every state.

However, more specifically, this specialized form of commercial insurance protects you from the costs of accidents, property damage, injuries, and legal claims. Whether you own one single-axle rig or a fleet of super dumps and transfer trucks, you need protection tailored to the kind of work you do and the vehicles you operate.

Dump truck insurance is especially critical for businesses involved in hauling loose materials like gravel, demolition debris, landscaping supplies, or construction waste. And if you’re running semi-trailer bottom dumps, side dumps, or end dumps, the stakes are even higher because of added trailer risks. With the right policy in place, your operation is covered no matter what’s on the road … or what gets left behind.

Also, there is coverage for the commercial space used as a terminal, and even for the drivers and mechanics. So, who will find commercial dump truck insurance useful? This insurance is for

- Standard dump truck businesses

- Semi-trailer end dump businesses

- Transfer dump truck businesses

- Super dump truck businesses

- Semi-trailer bottom dump truck businesses

- Side dump truck businesses

What is Covered by Dump Truck Insurance?

Dump truck insurance provides key coverages like liability and property insurance. But functionally, how that works for your business can vary. That is because dump truck insurance policies are modular. That means you can build your coverage around your specific needs. At a minimum, you’ll need liability coverage to meet state and federal requirements, but smart business owners typically add several other protections.

- Auto liability coverage pays for injuries or property damage you cause while operating your truck.

- Physical damage coverage pays for repairs or replacements if your truck is damaged by collisions, weather, theft, or vandalism.

- Medical payments or personal injury protection (PIP) helps cover medical bills if your driver is injured on the job.

- Emergency roadside assistance can save the day when a dump truck breaks down mid-route.

- Cargo insurance protects the materials you’re hauling if they’re damaged, lost, or stolen during transit.

- Non-trucking liability and bobtail insurance cover your truck when it’s not under dispatch or operating without a trailer.

- Commercial property coverage protects your terminal, tools, spare parts, and equipment if damaged or destroyed by covered perils.

- Workers’ compensation insurance is legally required in most states if you have employees, and it protects your team in case of job-related injuries or illness.

With these layers of protection in place, your business can operate with confidence, even in the face of an accident, equipment failure, or lawsuit.

Get all the best quotes from leading providers in a click of a button!

Liability Insurance for Dump Truck Businesses

Liability insurance will be very useful if you’re running a dump truck business that makes money by hauling debris, goods, or materials from other companies. Liability insurance has different types, and for dump truck businesses, carriers offer general liability insurance.

General liability insurance will cover claims that third parties file against your business. The language of general liability insurance covers claims for:

|

|

|

|---|---|---|

| Third-Party Personal Injuries | Third-Party Property Damage | Legal Expenses |

| Your dump truck business’s operations might cause injuries to third parties. For example, visitors might experience a slip and fall accident in the terminal. Those renting your dump truck might get injured due to sudden defects in the machine. If a third party files a personal injury claim against your business, general liability insurance will pay for medical expenses | Dump trucks are big and loud machines, and they might damage third-party property. For example, your dump truck’s horn might suddenly blow off due to defects, causing a person standing by to get surprised and drop their phone. If the person requests reimbursement, general liability insurance will give the money on your behalf | Third parties who got injured or had their property damaged because of your business might take legal action. In such a situation, general liability insurance is to the rescue and will cover attorney fees, compensatory payments ordered by the court, and other legal costs |

Insurance companies underwrite general liability insurance for dump truck businesses comprehensively. At an additional cost, you can include add-ons to general liability insurance for more protection. These are:

|

|

|

|---|---|---|

| Advertising Injury Coverage | Products and Completed Operations | Rented Premises Liability Coverage |

| Advertising injury coverage is an add-on in general liability insurance that covers claims for reputational and advertising harm. Use this to cover attorney fees, compensatory payments, and other legal costs if your dump truck business committed or allegedly committed slander, libel, false advertising, and copyright infringement | A client you’ve once worked with before might sue for personal injuries or property damage. In such a situation, products and completed operations coverage will pay for the associated expenses | If you’re renting a warehouse or a terminal to store your dump truck, rented premises liability coverage is handy. This will cover costs if the commercial space you’re renting is destroyed by fire. If the property owner demands payment, rented premises liability coverage will provide money on your behalf |

Commercial Property Insurance for Dump Truck Business

Just like a snow plowing business, you need commercial property insurance too. Commercial property insurance will provide coverage for the commercial building you’re using to store the dump truck, spare parts, other materials for maintenance, documents, computers, and more. This insurance covers the following perils:

|

|

|---|---|

| Building Destruction | Building Damage |

| If your dump truck business’s commercial building burns to the ground or crumbles due to extreme weather, commercial property insurance will reimburse your losses. Note that destruction due to earthquakes and floods isn’t covered | Fire, extreme weather, theft, vandalism, and other covered perils will incur some damage to your building’s structures. In such an event, commercial property insurance will give reimbursements based on the value of the damaged building structures |

Commercial property insurance comes with inclusions that allow it to not only protect your dump truck business’s building but also other physical assets. These are:

|

|

|---|---|

| Stocks and Contents Coverage | Business Equipment and Tools Coverage |

| Inside your dump truck business’s warehouse and office are oil, spare parts, computers, furniture, and other valuable items. If these become damaged or lost due to fire, theft, vandalism, and other covered perils, stocks and contents coverage will reimburse your losses based on the value of the items | You have trailers, jacks, drills, and other materials used to maintain the dump truck. Business equipment and tools coverage will reimburse losses if such items get lost or damaged within the business premises due to fire, theft, vandalism, and other covered perils |

Actual Cash Value vs Replacement Cost

Commercial property insurance provides reimbursements based on the actual cash value or replacement cost of the scheduled property. The table below explains the difference between the two:

|

|

|---|---|

| Actual Cash Value | Replacement Cost |

| Actual cash value commercial property insurance will provide reimbursements based on the depreciated value of the scheduled property. This one will give a lesser payout if a covered peril happened when your property has aged a lot | The reimbursement replacement cost commercial property insurance provides doesn’t take depreciation into account. This means that you’ll recover the full value of the damaged or destroyed scheduled property, regardless of its age |

Commercial Auto Insurance for Dump Truck Business

Your dump truck can’t operate legally if it’s not covered with commercial auto insurance. Commercial auto insurance is a coverage for vehicles used for business purposes, whether they be a large dump truck, an automobile, a commercial van, a tractor-trailer, or any other vehicle. Commercial auto insurance provides the following protection for your dump truck business:

| Coverage | Function |

|---|---|

Auto Liability Coverage |

While carrying a heavy load, a dump truck’s brakes can fail. It’s also possible to hit someone due to blind spots. Either way, you’ll have to pay for the medical treatment of injured third parties and reimbursement for damaged property. The job of auto liability coverage is to cover such expenses on your behalf. Note that auto liability coverage will only apply if your dump truck caused an accident while on dispatch |

Physical Damage Coverage Physical Damage Coverage |

Physical damage coverage has two forms – collision and comprehensive. Collision physical damage coverage will pay for parts repair or replacement if your dump truck collided with a vehicle or object and incurred damage On the other hand, comprehensive physical damage coverage will cover parts repair or replacement if your dump truck incurred damage due to fire, theft, vandalism, hail, storm, and other covered perils |

Emergency Roadside Assistance Emergency Roadside Assistance |

Your dump truck might stall on the road due to engine failure, battery failure, burst tires, defective brakes, etc. In connection, the job of auto liability coverage is to reimburse what you spent for towing, battery jump start service, gas delivery, tire delivery and replacement, and other roadside assistance services |

MedPay/Personal Injury Protection MedPay/Personal Injury Protection |

Vehicular accidents not only injure third parties but also the driver of your dump truck. The purpose of medical payments coverage (MedPay) and personal injury protection is to cover his or her medical treatment/procedure, as well as hospitalization |

Other Coverage for Your Dump Truck

Aside from commercial auto insurance, insurance companies also offer the following additional protection:

- Non-Trucking Liability Insurance

- Bobtail Insurance

- Cargo Insurance

Non-Trucking Liability Insurance

You or another driver might use the dump truck for non-commercial use. If an accident happens during such time, non-trucking liability insurance will pay for the medical expenses of injured-third parties. It will also provide reimbursements to individuals who had their property damaged because of the accident.

Bobtail Insurance

Bobtail insurance is useful if you’re using transfer dump trucks and semi-trailer end dump trucks. This will cover medical payments and reimbursements for damaged property and personal injuries if your dump truck causes an accident while there’s no trailer attached. By the way, there’s an insurance that works like non-trucking liability insurance and bobtail insurance at the same time – unladen insurance.

Cargo Insurance

Cargo insurance will pay out if the cargo your dump truck was carrying was either damaged or lost. Since dump trucks rarely carry expensive cargo, this kind of coverage usually isn’t that expensive compared to cargo insurance for other kinds of motor trucks.

Commercial Fleet Insurance

Commercial auto insurance will only allow you to cover one dump truck. That’s why it’s not a useful coverage if you own five or more units. In this situation, the insurance product you’ll need is commercial fleet insurance.

Commercial fleet insurance will provide coverage to five or more dump trucks under one policy. Also, its cost is way cheaper than if you decide to cover the dump trucks separately. Commercial fleet insurance doesn’t differ from commercial auto insurance in terms of the protection it provides as it includes auto liability coverage, physical damage coverage, medical payments/personal injury protection, and emergency roadside assistance coverage.

Workers Compensation Insurance for Dump Truck Business

Mechanics and drivers might experience repetitive motion injuries, chronic back pains, cuts, burns, and others. It’s your duty to look after employees when they experience a work-related injury or disease. Do not do this and you might be sued.

Of course, you don’t want to use business funds when looking after employees. This is why you should get workers’ compensation insurance.

Workers’ compensation insurance is required by law the moment one or more employees are in your dump truck business. Failure to get this will result in fines or imprisonment. The function of workers’ compensation insurance is to cover:

| Coverage | Function |

|---|---|

Employee Treatment/Medical Procedure Employee Treatment/Medical Procedure |

Workers’ compensation insurance will pay for the medical treatment/procedure of an injured or sick employee such as therapies and surgeries |

Hospitalization Hospitalization |

If your dump truck business’s employee needs to stay in the hospital for a while, workers’ compensation insurance will take care of hospital bills |

Medication Medication |

Workers’ compensation insurance will also cover the expenses for medicines prescribed by the attending doctor of your injured or sick employee |

Rehabilitation Rehabilitation |

Injuries such as fractures, repetitive motion injuries, and others need rehabilitation or else, these will significantly reduce the employee’s quality of life. Workers’ compensation insurance covers rehabilitation costs so that the employee is fit to work once again |

Lost Income Compensation Lost Income Compensation |

Healing from an injury is to stop working for a while. Workers’ compensation insurance will help you compensate for the lost earnings of an injured or sick employee. Lost income compensation will be equal to two-thirds or 67% of the average weekly wage |

Death Benefits Death Benefits |

Workers’ compensation insurance provides death benefits if your employee dies from his injury or sickness. Death benefits include but are not limited to funeral payments and allowance to dependents |

Is a Dump Truck Business Perilous for Employees?

A dump truck business is very perilous for employees. There are many recorded incidents that prove this. We’ve compiled some in the table below:

| Incident Date | What Happened? |

|---|---|

| November 2, 2020 | An employee was replacing the transmission of a dump truck and had to raise the vehicle’s cockpit to do so. While doing the task, the beam that prevented the cockpit from crashing down failed to do its purpose. As a result the employee was crushed |

| May 13, 2021 | An employee was facilitating the exit of a dump truck that unloaded a trailer. As the dump truck was backing up, it hit the employee |

How Much Does Dump Truck Insurance Cost in 2025?

In 2025, the average cost to insure a dump truck is around $438 per month, or $5,250 per year, for a $1 million general liability policy. That’s for a single, relatively new dump truck operated by a driver with a clean record for one type of coverage: general liability insurance.

And that’s just the starting point. Insurance premiums vary widely depending on the number of trucks, how far you haul, what materials you transport, your claims history, and the safety records of your drivers.

For example, operators with multiple trucks may qualify for fleet insurance, which typically lowers the cost per vehicle. Meanwhile, older trucks with good maintenance records often cost less to insure than new ones with unproven reliability.

Here’s a snapshot of real-world 2025 pricing:

- CoverWallet: $300/month – great for quote comparison tools and fast online approval.

- Geico: $350/month – known for strong discounts and simple commercial auto coverage.

- Progressive: $430/month – excellent for larger fleets and those needing help with state filings.

The key takeaway? There’s no one-size-fits-all policy. Your costs will reflect your unique operation, and so the more you can customize and compare, the better.

If you’re curious about how much you can expect it to cost you to insure your dump truck, simply click one of the ‘Get Quotes’ buttons on this page and follow the process to find some of the cheapest dump truck insurance quotes online from the best insurance companies.

How to Save on Dump Truck Insurance

You can’t avoid insurance, but you can avoid overpaying for it. The most effective strategy is to

- Compare quotes from multiple carriers. Each insurer evaluates risk differently, and premiums can vary by hundreds of dollars for the same coverage.

- Bundle your policies when possible. Combining commercial auto, property, liability, and workers’ comp coverage can unlock multi-policy discounts. Many carriers offer special programs for construction and transportation businesses.

- Train your drivers, document maintenance, and install safety devices. Insurers want to know you’re running a safe, responsible operation. Use that to your advantage.

- Risk management equipment: Many carriers offer dashboard cams or apps to help you manage your fleet or encourage your drivers to avoid distracted driving, and these come with discounts.

- Review your policy annually. As your business changes, so should your coverage. Adjust your deductibles, drop unneeded endorsements, and negotiate better rates as you build experience and trust with your provider.

Following these steps can help you manage the cost of dump truck insurance for your business.

Get all the best quotes from leading providers in a click of a button!

Best Dump Truck Insurance Companies

Instead of going to Google and typing in “dump truck insurance near me” and hoping for the best, it’s often a good idea to know which companies excel at providing coverage for vehicles like dump trucks. Here are the best dump truck insurance companies to work with. Know about their pros, cons, and pricing for a $1 million general liability coverage.

CoverWallet Dump Truck Insurance

Pros

- Cancel a policy anytime

- Get insured online

- Stable rates

- Easy policy management with the MyCoverWallet app

Cons

- Doesn’t help with state filings

CoverWallet’s dump truck insurance offers commercial auto insurance, nontrucking liability insurance, bobtail insurance, and other specialized insurance for dump truck businesses. You can also opt to go for commercial property insurance and workers’ compensation insurance if they apply to your business operations. Work with CoverWallet because it insures you instantly online.

Best for: Dump truck insurance quotes comparison online

Average cost: $300 per month

Our rating: 10/10

Geico Dump Truck Insurance

Pros

- Basic commercial auto insurance for a dump truck business with a lot of discount options

Cons

- Other business insurance policies might be written by third-party companies

Geico tends to cover dump trucks under its commercial auto insurance policies. Their policies will protect you from damage to your vehicle, injuries caused to other motorists or pedestrians, damage to others’ property, and injury to the driver of the dump truck. Geico currently doesn’t offer coverage for semi-trucks and trailers.

Best for: Dump truck insurance with discounts

Average cost: $350 per month

Our rating: 9/10

Progressive Dump Truck Insurance

Pros

- Helps with state filings

- Has specialized motor carrier insurance policies for dump truck businesses

Cons

- Specific coverages are restricted by mileage

Unlike Geico, Progressive offers specific policies for dump trucks, and their coverage includes primary liability insurance and physical damage coverage. Progressive also works closely with motor carriers to make state and federal financial responsibility filings for them.

Best for: Commercial fleet insurance for dump truck businesses

Average cost: $430 per month

Our rating: 8/10

Do I need dump truck insurance if I only operate seasonally?

Yes. Even if your truck only runs part of the year, accidents can happen at any time. Some insurers offer seasonal or short-term policies for businesses with off-season downtime.

Can I insure multiple dump trucks under one policy?

Absolutely. Fleet insurance is designed to cover five or more vehicles under a single plan—and it’s typically more cost-effective than individual policies.

What’s the difference between bobtail and non-trucking liability?

Bobtail coverage applies when the truck is being driven without a trailer, often between loads. Non-trucking liability kicks in when the truck is being used for personal, non-business reasons.

Does my policy cover my terminal or maintenance garage?

Only if you have commercial property insurance. This add-on protects your buildings, tools, spare parts, and office equipment from covered losses like fire, theft, or storm damage.

Big Trucks, Bigger Risks: Cover Them Right

Dump trucks are workhorses, and with that power comes liability. Whether you’re managing a single rig or an entire fleet, your business can’t afford to be underinsured. With the right policy, you’re not just covering the cost of repairs or replacement. You’re protecting your team, your reputation, your assets, and your future.

Bottom line: The heavier the load, the stronger your protection needs to be. Don’t haul risk, insure it.

Also read:

- Dump Trailer Insurance: Cost & Quotes From $1

- Bulldozer Insurance: Coverage, Cost & Quotes From $15

- Forklift Insurance: Coverage, Cost & Quotes From $15

- Excavator Insurance & Digger Insurance: Cost & Quotes From $11

- Crane & Riggers Liability Insurance: Cost & Quotes from $11

- Commercial Construction Insurance: Cost, Companies, Types & Quotes From $11