Introduction

Owning a car is a privilege and is one of the fastest and most convenient ways to commute between one place and another by most of us in our daily lives, even under pandemics. We invest in cars for the sole purpose of having independence and private transportation which is an easier way to get from one place to another, whether it’s shopping for groceries or visiting family or friends in faraway places.

Vehicle types range from family cars such as SUVs, sedans, station wagons and small cars to classic cars, sports cars, 4×4 jeeps and luxury cars – and more. This article provides guidance on the cheapest, most affordable and least expensive cars to insure these days for different vehicle types, brands, models, states and even ages, as young drivers and teenagers are normally considered a higher risk for insurance companies and as a result get higher car insurance quotes from them.

We must always keep in mind that car insurance rates are impacted by different elements, be it the vehicle type/brand/model/year, safety features and ratings, age/experience of the drivers, driving record, credit score, purpose of driving, mileage, state of residence, and the list can continue until next year.

Understanding what is the cheapest car to insure for the category that’s relevant to us helps us make wiser insurance choices and become more aware consumers, which gives us an advantage in this area. This guide is addressing just that, in detail. The provided content may help both veteran and new drivers alike.

The Cheapest Car to Insure

Based on our research, the car with cheapest insurance rates in 2023 across all brands, models, vehicle types, states and drivers is a 2011 Subaru Outback that has an average insurance cost of$29 per month or $352 a year with the cheapest car insurance company, GEICO, approximately $46 a month or $350 a year with Erie and USAA and approximately $598 a year or $49 per month with State Farm and Progressive – a bargain indeed!

Cheapest Cars to Insure

Below are the best and most affordable cars to insure at the cheapest average rates in all states in the USA:

| Vehicle |

Average Cost Per Month |

Average Cost Per Year |

| 1995 Honda Civic |

$49 |

$550 |

| 2017 Smart Fortwo |

$50 |

$598 |

| 2011 Subaru Outback |

$59 |

$694 |

| 2001 Honda Civic |

$73 |

$850 |

| 2014 Mercedes-Benz CLA-Class Coupe |

$73 |

$854 |

| 2016 Volkswagen Jetta |

$84 |

$991 |

| 2007 BMW328i |

$85 |

$998 |

Cheapest Cars to Insure by State

Here are the cheapest cars to insure in each and every state in the USA in 2023 based on our findings:

| State |

Car |

Monthly cost |

Annual cost |

| Alaska |

Jeep Wrangler Black and Tan |

$80 |

$960 |

| Alabama |

Hyundai Kona SEL+ |

$116 |

$1373 |

| Arkansas |

Jeep Wrangler Black and Tan |

$116 |

$1373 |

| Arizona |

Chevrolet Express G2500 |

$108 |

$1288 |

| California |

Jeep Wrangler Black and Tan |

$133 |

$1548 |

| Colorado |

Chevrolet Express G2500 |

$137 |

$1619 |

- The cheapest car to insure in Alaska is Jeep Wrangler Black and Tan with an average insurance cost of $80 a month or $960 a year

- The cheapest car to insure in Alabama is Hyundai Kona SEL+ with an average insurance cost of $116 a month or $1373 a year

- The cheapest car to insure in Arkansas is Jeep Wrangler Black and Tan with an average insurance cost of $116 a month or $1373 a year

- The cheapest car to insure in Arizona is Chevrolet Express G2500 with an average insurance cost of $108 a month or $1288 a year

- The cheapest car to insure in California is Jeep Wrangler Black and Tan with an average insurance cost of $133 a month or $1548 a year

- The cheapest car to insure in Colorado is Chevrolet Express G2500 with average insurance cost of $137 per month or $1619 per year

Cheapest New Cars to Insure

A car’s age is an essential factor in determining insurance rates. Newer cars look undeniably flawless and sleeker than older cars, resulting in higher chances of theft, which is why newly bought cars tend to have a more expensive insurance rate than used cars. Below are the top 10 cheapest newly-bought car insurance costs per year. A Mazda CX-3 Sport is the most affordable new car to insure with an average annual insurance cost of $1,324, while a Honda HR-V LX has the tenth cheapest rate of $1,377.

| Cheapest New Cars to Insure |

|

|

| Rank |

Car Model |

Average Annual Insurance Cost |

| 1 |

Mazda CX-3 Sport |

$1,324 |

| 2 |

Honda CR-V LX |

$1,333 |

| 3 |

Jeep Wrangler Sport S |

$1,334 |

| 4 |

Subaru Outback 2.51 |

$1,335 |

| 5 |

Fiat 500X Pop |

$1,336 |

| 6 |

Honda Odyssey LX |

$1,353 |

| 7 |

Subaru Forester 2.5L |

$1,373 |

| 8 |

Mazda CX-5 |

$1,374 |

| 9 |

Jeep Renegade Sport |

$1,374 |

| 10 |

Honda HR-V LX |

$1,377 |

Cheapest Used Cars to Insure

As mentioned, a car’s age is an essential determinant of clients’ auto insurance rates. Older and used cars have lesser values than newly bought ones because they tend to have more flaws, with possibilities of being modified using unoriginal parts. Below are the top 10 cheapest used cars to insure. The cheapest car model to insure is the Saturn SL1, which costs $1,134 annually, while the tenth cheapest is the Pontiac Sunfire, which costs $1,292 annually.

| Cheapest Used Cars to Insure |

|

|

| Rank |

Car Model |

Average Annual Insurance Cost |

| 1 |

Saturn SL1 |

$1,134 |

| 2 |

Kia Spectra Base |

$1,161 |

| 3 |

Mercury Sable LS |

$1,180 |

| 4 |

Ford Escort |

$1,221 |

| 5 |

Ford Escort ZX2 |

$1,236 |

| 6 |

Pontiac Grand Am SE1 |

$1,272 |

| 7 |

Buick Century Limited |

$1,273 |

| 8 |

Pontiac Grand Prix SE |

$1,279 |

| 9 |

Chevrolet Geo Prizm Base |

$1,290 |

| 10 |

Pontiac Sunfire |

$1,292 |

Cheapest Luxury Cars to Insure

Male drivers with more expensive cars are more likely to have higher rates, since statistically it is a population that carries a higher risk of being involved in car accidents, plus the fancy cars will require expensive repairs and are more likely to be vulnerable to vehicle theft as well.

Cheapest Small Cars to Insure

Smaller cars are more expensive to insure because they tend to get involved in accidents. Statistically, small cars are involved in accidents more than bigger cars because they are faster and easier to maneuver. This is why many abusive drivers take advantage of it by driving recklessly, causing collisions that may or may not involve other cars. Below are the top 10 cheapest small cars to insure. The most affordable small car to insure is the 2016 Chevrolet Cruze LS that costs an annual average of $1,337, while the tenth cheapest is the 2016 Subaru Impreza that charges a yearly average of $1,421.

| Cheapest Small Cars to Insure |

|

|

| Rank |

Car |

Average Annual Insurance Cost |

| 1 |

2016 Chevrolet Cruze LS |

$1,337 |

| 2 |

2016 Dodge Dart |

$1,342 |

| 3 |

2016 Buick Verano |

$1,348 |

| 4 |

2016 Honda Civic |

$1,384 |

| 5 |

2016 Ford Focus |

$1,388 |

| 6 |

2016 Volkswagen Golf |

$1,393 |

| 7 |

2017 Hyundai Elantra |

$1,408 |

| 8 |

2013 Mazda Mazda3 |

$1,414 |

| 9 |

2016 Toyota Corolla |

$1,419 |

| 10 |

2016 Subaru Impreza |

$1,421 |

Read more:

Ford Focus Insurance Cost

Chevy Cruze Insurance Cost

Toyota Corolla Insurance Cost

Honda Civic Insurance Cost

Cheapest SUVs to Insure

SUVs are known to be quite pricey, which is why insurance costs for an SUV are considerably higher than sedans. Generally, repairs costs for SUVs are more expensive because its overall value is high in the market for automobiles, which means its parts are costly during repairs. Below are the top 10 cheapest SUV models to insure annually. The cheapest SUV to insure is the Honda CR-V, with a $2,346 average annual cost, while the tenth cheapest is the Ford Explorer, with a $3,587 average yearly price.

| Cheapest SUV to Insure |

|

|

| Rank |

SUV Model |

Average Annual Insurance Cost |

| 1 |

Honda CR-V |

$2,346 |

| 2 |

Toyota RAV4 |

$2,475 |

| 3 |

Chevrolet Equinox |

$2,560 |

| 4 |

Ford Escape |

$2,834 |

| 5 |

Chevrolet Tahoe |

$2,888 |

| 6 |

Chevrolet Traverse |

$3,073 |

| 7 |

Toyota Highlander |

$3,283 |

| 8 |

Jeep Grand Cherokee |

$3,347 |

| 9 |

Toyota 4Runner |

$3,355 |

| 10 |

Ford Explorer |

$3,587 |

Cheapest Sedans to Insure

Generally, sedans are way cheaper than SUVs, so although it might be smaller in size, sedans’ insurance rates are way cheaper. This car type’s parts do not cost as much as SUVs, so it is cheaper to insure it. Below are the top 10 most affordable sedan models to insure. The cheapest is the 2016 Mercedes-Benz CLA-Class Coupe, which has an average annual cost of $854, and the tenth cheapest is the 2016 Honda Accord 4-Door Sedan with an average yearly cost of $1,100, which is still less expensive than the most affordable SUV to insure.

| Cheapest Sedans to Insure |

|

|

| Rank |

Sedan Model |

Average Annual Insurance Cost |

| 1 |

2014 Mercedes-Benz CLA-Class Coupe |

$854 |

| 2 |

2016 Volkswagen Jetta |

$991 |

| 3 |

2016 Chevrolet Malibu Premier |

$1,025 |

| 4 |

2016 Chrysler 200 |

$1,029 |

| 5 |

2016 Volkswagen Passat |

$1,032 |

| 6 |

2016 Chevrolet Cruze Limited LTZ |

$1,039 |

| 7 |

2016 Volvo S80 Premier Plus |

$1,054 |

| 8 |

2016 Chevrolet Impala 2LTZ |

$1,094 |

| 9 |

2016 Subaru Legacy 2.5 Limited |

$1,097 |

| 10 |

2016 Honda Accord 4-Door Sedan |

$1,100 |

Cheapest Hatchback to Insure

Based on our findings, the cheapest hatchback to insure is 2017 Smart Fortwo with an average insurance cost of only $598 a year or $50 a month, which is over half the national average car insurance cost, making it one of the cheapest cars to insure as well.

Cheapest Pickup Trucks to Insure

Pickup trucks are generally more expensive than cars. With a high value in the automobile market, pickup trucks are undoubtedly more costly to insure. Below are the top five cheapest pickup trucks to insure. The cheapest is the 2019 Nissan Frontier S, which costs $1,361 and the fifth cheapest is the 2019 Toyota Tacoma SR, which costs $1,405.

| Cheapest Pickup Trucks to Insure |

|

|

| Rank |

Pickup Truck Model |

Average Annual Insurance Cost |

| 1 |

2019 Nissan Frontier S |

$1,361 |

| 2 |

2019 GMC Canyon SL |

$1,369 |

| 3 |

2019 Ford F150XL |

$1,374 |

| 4 |

2019 Chevrolet Colorado |

$1,375 |

| 5 |

2019 Toyota Tacoma SR |

$1,405 |

Cheapest Sports Cars to Insure

Unquestionably, sports cars are more expensive than the average car. This expensiveness is because sports cars have more demanding requirements for racing against other cars, so it is also costly to insure one. Below are the top 10 cheapest sports car models to insure annually. The cheapest is the 2017 Mazda MX-5 Miata, which costs an average of $1,284, while the tenth cheapest is the 2018 Subaru WRX STI, which costs an average of $1,688.

| Cheapest Sports Cars to Insure |

|

|

| Rank |

Sports Car Model |

Average Annual Insurance Cost |

| 1 |

2017 Mazda MX-5 Miata |

$1,284 |

| 2 |

2017 Fiat 124 Spider |

$1,353 |

| 3 |

2017 BMW Z4 Roadster |

$1,561 |

| 4 |

2018 Chevrolet Corvette Stingray |

$1,562 |

| 5 |

2017 Subaru BRZ / 2017 Toyota 86 |

$1,580 |

| 6 |

2017 Porsche Boxster |

$1,580 |

| 7 |

2018 Audi TT |

$1,584 |

| 8 |

2018 Chevrolet Camaro SS |

$1,606 |

| 9 |

2017 Ford Mustang GT |

$1,656 |

| 10 |

2018 Subaru WRX STI |

$1,688 |

Cheapest Car Models to Insure

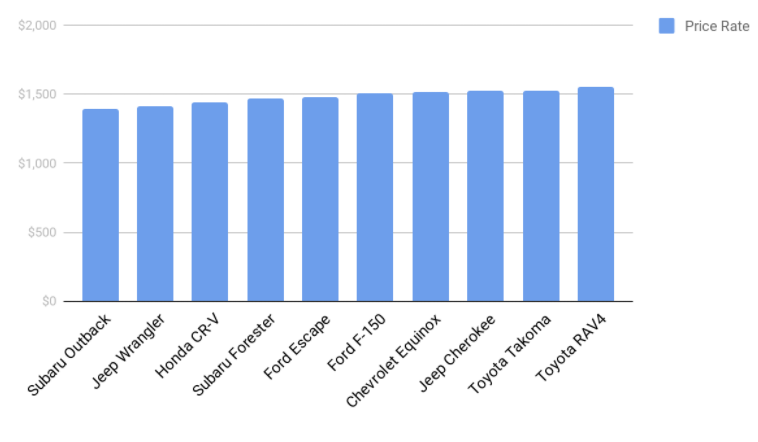

Car brands have upped their game with the different car designs they have released over the years, and as we reach halfway through 2022, car brands have created lists of their oldest to newest car models that are highly recommended for their performance and price. Below is a graph that shows statistical data on the cheapest car models to insure in 2022.

Subaru Outback is one of the cheapest SUVs to insure at a starting price of $1,392. The Toyota RAV4, one of Toyota’s 2022 compact crossover SUVs has set the bar of being the most expensive SUV to insure at a price rate of $1,555.

However, the insurance price rates of these car models vary in different states across the United States, as well as the driver’s demography and driving history.

Cheapest BMW to Insure

The Bayerische Motoren Werke (BMW) is a famous German multinational brand known for its production of luxury cars and motorcycles. Moreover, the BMW brand has been growing over the years and continues to produce high-end performance vehicles suitable for consumers of all ages and desired driving comfort.

BMW also offers competitive insurance rates for their customers. The average price range for BMW car models starts at $186 per month, and $2,220 per year.

Vehicle owners should know that BMW cars are among the cheapest luxury cars to insure, depending on the BMW car model. BMW customers should also note that the average insurance cost does not take additional features into consideration, such as its safety features that support anti-theft, especially since BMW is a popular luxury car, among other great advantages of other additional features.

The cheapest BMW to insure is BMW 328i, averaging $150 a month or $1800 a year across all model years. The cheapest BMW 328i to insure is a 2007 BMW 328i, with an average insurance cost of only $85 a month, or $1,000 a year.

A full breakdown of BMW 328i insurance cost by year can be found in our BMW insurance cost research.

For your convenience, please find below the list of the cheapest to the most expensive BMW models to insure:

| BMW Model |

Average insurance cost per month |

Average insurance cost per year |

| 328i |

$150 |

$1,800 |

| M4 |

$160 |

$1,900 |

| M6 |

$160 |

$1,900 |

| 6 Series |

$160 |

$1,900 |

| i8 |

$165 |

$2,000 |

| 5 Series |

$170 |

$2,050 |

| 7 Series |

$170 |

$2,050 |

| M3 |

$170 |

$2,050 |

| X6 |

$170 |

$2,050 |

| 3 Series |

$180 |

$2,150 |

| X3 |

$180 |

$2,150 |

| X5 |

$180 |

$2,150 |

| i3 |

$180 |

$2,160 |

| X1 |

$192 |

$2,300 |

| X2 |

$200 |

$2,383 |

| 1 Series |

$200 |

$2,400 |

| 2 Series |

$200 |

$2,400 |

| 4 Series |

$215 |

$2,575 |

| M2 |

$242 |

$2,900 |

| X4 |

$240 |

$2,900 |

| M5 |

$270 |

$3,250 |

| Rank |

BMW Car Model |

Average Base Price |

| 1 |

2 Series |

$33,150 |

| 2 |

3 Series |

$33,450 |

| 3 |

4 Series |

$41,950 |

| 4 |

5 Series |

$51,200 |

| 5 |

6 Series |

$77,600 |

| 6 |

7 Series |

$81,500 |

| 7 |

i3 |

$46,250 |

| 8 |

i8 |

$143,400 |

Cheapest Audi to Insure

Another type of German luxury car is the Audi AG, known for its partnership with Volkswagen Group, this well-respected automobile manufacturer is famous for its car designs, engineers, products, and luxury vehicles. Just like the BMW, the Audi brand is another type of luxury car that comes with an expensive insurance price, with different and brand new luxury cars produced and currently in production.

Moreover, Audi companies offer consumers insurance prices for them to be aware of the expenses the automobile insurance can cover. The average insurance price rate for Audi car models ranges around $150 to $200 a month. In contrast, the yearly insurance rate varies due to the different features that different Audi car models contain.

Below is a table that offers the different Audi car models ranging from cheapest to the most expensive to insure in 2022.

| Rank |

Audi Car Model |

Average Base Price |

| 1 |

A3 |

$31,200 |

| 2 |

A4 |

$34,900 |

| 3 |

A4 Allroad |

$44,000 |

| 4 |

A5 |

$47,600 |

| 5 |

A6 |

$41,200 |

| 6 |

A7 |

$47,600 |

| 7 |

Q7 |

$49,000 |

| 8 |

R8 |

$162,900 |

| 9 |

RS7 |

$100,700 |

| 10 |

S8 |

$115,900 |

The cheapest Audi car model to insure is the Audi A3 that has an average base price of $31,200 and a monthly insurance rate of $191. As for the most expensive Audi car model to insure, the Audi R8 has an average base price of $162,900 with a monthly insurance rate of $197.

Cheapest Cars to Insure for Teenage Drivers (2022)

Remember back when you were a teenager? Things were probably a little bit simpler. Cars were cheaper, you could buy them in cash with a part-time job, and maintenance was affordable. Today, however, the story is completely different. In fact, obtaining a vehicle in today’s constantly expanding auto market is almost impossible unless you have a near-perfect credit score, are willing to put down massive amounts, or if you choose an affordable car to go on your teen insurance policy.

That being said, though, there are still a number of different affordable car models that you can choose from for your teen. The vehicles discussed below are all brand-new 2022 autos that include the latest safety technology, which will not only give you peace of mind but may also reduce the cost of your teenage driver’s insurance!

In this section, we’re going to be looking at the cheapest cars that parents/guardians can buy for their teenage drivers without having to spend an arm and a leg on insurance!

Quick Stats on Teen Drivers and Auto Insurance

Before we go into our in-depth list of cheap cars for teens to insure, let’s take a couple of minutes to go through some quick statistics about teenage drivers and teen drivers insurance. Many parents are caught unaware, not knowing exactly how expensive teenage driver’s insurance is. They often reference into the past whenever they were teenagers and how cheap and “affordable” their insurance policies were. The only problem is- that was a long time ago.

Today, teenage drivers are far more likely to get into an accident than experienced adult drivers who tend to be more aware of the road around them. Even with today’s advanced automotive safety technology, finding solutions to the age-old problem of keeping young teens safe on the road is still far from actualization.

For example, teen drivers between ages 15 and 20 account for over 8% of all of the United States’ accidents. To give you a better perspective, drivers between 15 and 20 make up 5.5% of all of the drivers in the United States ! That’s an incredibly high number of accidents compared to a relatively small group of drivers.

Of the teenagers who do pass away from injuries or being involved in a motor vehicle accident, nearly 20% of them are impaired drivers and 50% of them were not even wearing a seatbelt. The remaining 30% seemed to die from natural causes related to their injuries.

As you’re probably already putting together, teenagers are a very risky group of humans to insure. There’s a very high likelihood that they’re going to drink or smoke and drive, or not care enough about their lives to follow routine safety procedures… until it’s too late.

This is the reason why insurance companies regularly charge double or even triple the amount in premiums for insuring teenage drivers as they do to adult drivers. They’re taking a gamble and hoping that your teen doesn’t do something stupid or make a beginner’s mistake.

Best Cars for Teenager Insurance

One of the best methods that you can do to reduce the price of your teenage driver’s insurance is to purchase them a car that is cheap to insure for the high risk drivers they are. According to GEICO , over 25% of 16-year old drivers crash a car during their first year of ownership . This means that the best idea is usually to either get them an old used vehicle or purchase a new 2020-2022 vehicle that’s fully insured and comes loaded with safety features.

Now, we’re going to show you our list of the 4 best cars for teenager, new and young driver insurance that will help you save money on your teenage driver’s insurance while still providing top-notch safety features that will, hopefully, reduce their chances of being involved in a deadly motor vehicle accident.

#1- The Mazda Miata

The Mazda Miata has been around since the late-1990s and is the only convertible car offered by the Japanese auto manufacturer Mazda. Today, the model is just as strong as it’s ever been. The only real difference is that today’s Miatas have better suspension, more fuel-efficient engines, a slightly larger body frame, air-conditioning, and electronically-controlled convertible switches.

The average cost to insure a teenager on a new 2022 Miata is $2,580 per year, which translates to around $215 per month for a full year-long coverage auto insurance policy. Not only is it affordable, but what teen doesn’t like the idea of cruising around in a drop-top?

#2- Volkswagen Golf

The original Volkswagen Golf was released in 1974 and was designed to be a more “regular” replacement for the iconic Beetle. It featured larger trunk space, more head room, and a more aerodynamic shape. While production was temporarily discontinued, they recently rebooted the brand in the United States and it has since become one of the most popular economy hatchback vehicles on the market!

The average cost to insure a teenage driver on a VW Golf is $2,671 per year, or $223 per month, for the sport-friendly GTI model.

#3- Subaru Outback

The Subaru Outback is a classic family sedan that has made waves for decades. It features Subaru’s ultra-reliable “boxer” engines, has a reputation for lasting forever, and is loaded with safety features. It has plenty of trunk space, spacious seating, and features an all-wheel-drive setting so you’ll never have to worry about your teen getting stuck in the mud.

The current average teenage driver price for full coverage insurance on a Subaru Outback is $2,695 per year, which translates to around $225 per month. Not bad for an iconic car like the Outback!

#4- Toyota Sienna

While the Toyota Sienna may be known for being somewhat of a “soccer mom car,” it makes for a great option as far as your teen driver is concerned. Not only will your teen driver have plenty of space to carpool with their friends, but you’ll also have peace of mind knowing that your child is driving with Toyota’s award-winning vehicle safety features. The current price to insure a new 2022 Toyota Sienna minivan is $2,758 per year, equaling out to $230 per month.

Cheapest Used Car to Insure for Teenager

The cheapest used cars to insure for teenagers, young and new drivers on a parents policy are Subaru Outback and Mazda CX-3. Here is some more information:

| Vehicle |

Average Monthly Premium |

Average Annual Premium |

| 2022 Honda Odyssey LX |

$337.08 |

$4,045 |

| 2022 Honda Accord |

$284.58 |

$3,415 |

| 2022 Subaru Outback 2.5I |

$281.5 |

$3,378 |

| 2022 Toyota Corolla |

$282.41 |

$3,389 |

| 2022 Toyota Prius |

$283 |

$3,396 |

| 2022 Ford Fusion |

$285.01 |

$3,421 |

| 2022 Mazda CX-3 |

$282.16 |

$3,386 |

| 2022 Honda HR-V |

$282.91 |

$3,395 |

| 2022 Honda CR-V |

$284.83 |

$3,418 |

| 2022 Ford Escape S |

$286.5 |

$3,438 |

| 2022 Subaru Forester |

$288.16 |

$3,458 |

| 2022 Jeep Compass |

$288.41 |

$3,461 |

| 2022 Mazda CX-5 |

$286 |

$3,431 |

– Rates vary based on multiple factors

Read more: Toyota Corolla insurance cost