Some of the products on this page come from partners who may compensate us when you click on their links or take specific actions. This helps us keep our content free. That said, our opinions are our own and based on independent analysis.

Car insurance can feel like a black box where two drivers with identical cars and clean records can pay wildly different premiums. With average rates up over 20% in the last year alone, it’s more important than ever to know how to shop for quotes the right way. This guide breaks down what affects your rates, how to compare offers effectively, and what real-life claim stories reveal about how insurers operate.

Key Takeaways:

- Comparing quotes from at least five companies can save you $85 or more per month.

- The average cost for good drivers has climbed to $158 per month, while drivers with tickets or accidents see rates closer to $233 monthly.

- Factors like your address, vehicle type, credit score, and annual mileage can swing your premium by thousands per year.

- Online forums reveal pitfalls with initial low quotes that balloon after underwriting reviews.

- Bundling policies, joining usage-based programs, and updating quotes at each renewal can dramatically lower what you pay.

- Shopping smart can mean the difference between staying on budget and overpaying by thousands.

What Are Car Insurance Quotes?

Car insurance quotes are estimates provided by insurance companies that represent the cost of your coverage based on information you supply. They are not final prices but rather a starting point for comparing different insurers.

- Definition: A car insurance quote is an estimated cost for auto insurance based on a combination of factors such as your driving history, vehicle type, coverage limits, and location.

- Purpose: The main aim is to give you a baseline before you commit to a full policy. It helps you understand what rates might look like for your situation.

Why They Matter for You

The quest for the perfect quote is essential because it ensures you:

- Stay within your budget: By comparing multiple quotes, you can find cheap driving insurance that fits your finances.

- Secure appropriate coverage: Avoid both underinsurance and overpaying for unnecessary extras.

- Make informed decisions: With car insurance quotes available at your fingertips, you become empowered to negotiate or shop around for a better deal.

ℹ️ Did You Know?

About 80% of drivers who shop online for car insurance find significant savings compared to those who stick with their current provider.

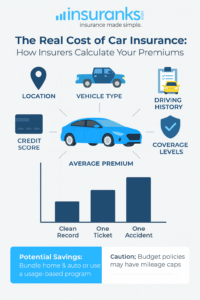

What Shapes Your Car Insurance Quotes

As an agent and adjuster, I’ve come to be used to how many people are caught off guard by the price of insurance. Most drivers assume tickets or accidents are the main factors driving premiums, but insurance pricing is far more complex. Where you live is often the biggest factor: living in a high-theft or congested area can add 25-50% to your rates compared to living in a quiet, low-traffic town. The car you drive is next: sports cars, large SUVs, and electric vehicles often cost far more to insure because of repair costs.

When you’re looking to insure a newer vehicle, remember, the entire car is now a computer. Your side mirror has lights and motion sensors connected to the alert system inside your vehicle. In the past, if your side mirror was knocked off, one from a similar car could be swiped from a junkyard. That is no longer the case, and even a small, simple claim like replacing a side mirror has become complex and expensive.

Your driving record still plays a huge role, with a single speeding ticket able to boost rates by 20-40% and an at-fault accident spiking rates by 40-70% for years. Annual mileage matters more than many realize; driving under 7,500 miles annually can cut premiums by 10-25%. Then there’s credit: in most states, drivers with poor credit pay 60-70% more than those with excellent scores.

Coverage choices matter just as much. Choosing state minimums lowers your premium but leaves you dangerously exposed to lawsuits and repair bills if you cause a serious accident. Higher liability limits and full coverage with collision and comprehensive protection cost more, but can save tens of thousands if something goes wrong. Finally, don’t overlook discounts: bundling home or renters insurance, safe driving programs, and even your profession can shave hundreds off your annual costs.

The Quest for Cheap Car Insurance Quotes

Securing cheap car insurance quotes doesn’t mean sacrificing quality coverage. Instead, it’s about finding the right balance between price and the protection you need.

Factors That Affect Car Insurance Quotations

Several factors determine the price of your insurance quote:

- Driving Record:

A clean driving record can dramatically lower your rates. Tickets, accidents or claims history might result in higher premiums. - Location:

Rates vary based on regional risk factors. Urban areas might face higher premiums than rural regions. - Vehicle Type:

The make, model, and age of your car matter. Sports cars or high-theft vehicles typically carry higher rates. - Coverage Level:

Opting for higher coverage limits or additional features, such as roadside assistance, can impact your final quote. - Credit Score:

In many states, insurers use your credit score as an indicator of risk. A strong credit history might help lower premiums.

Below is a table summarizing key factors that influence your insurance quote:

| Factor | Impact on Quote | Tips to Lower Impact |

| Driving Record | Major influence: accidents, violations raise rates | Take defensive driving courses, avoid violations |

| Location | Urban areas = higher risk | Consider policy adjustments if moving to a less dense area |

| Vehicle Type | High-performance cars are expensive | Choose vehicles with lower repair costs |

| Coverage Level | More coverage = higher cost | Evaluate your needs and select balanced coverage |

| Credit Score | Lower scores can increase rates | Improve your score by paying bills on time |

How to Find the Cheapest Vehicle Insurance Quotes

Finding the cheapest vehicle insurance requires a bit of research and comparison. Consider these steps to receive affordable auto insurance quotes:

- Gather Multiple Quotes: Don’t settle for the first driver’s insurance quote you receive. Instead, request quotes from several insurers.

- Utilize Comparison Tools: Websites dedicated to comparing car insurance quotations, like Insuranks, can quickly provide a range of options.

- Read Fine Print: Always check for any exclusions or limitations that might affect your claim in the future.

- Review Discounts: Look for discounts like safe driver, multi-policy, or good student discounts to shave off extra costs.

- Check Reviews: Ensure that the insurer not only offers cheap car insurance quotes but also has a reputation for good customer service.

Step-by-Step: Getting Drivers’ Insurance Quotes

Getting a driver’s insurance quote may seem like a chore, but breaking it into manageable steps can simplify the process. Here is a step-by-step guide:

Required Information

Before you start, have these ready:

- Your driver’s license

- Vehicle registration details

- Information on your driving history

- Details about your current coverage (if applicable)

- Your credit history (if required)

Steps to Secure Quotes

- Visit Reputable Comparison Websites:

Use trusted sites like Insuranks that offer a car insurance comparison online. - Fill Out Your Details Accurately:

Provide complete and truthful information to receive the most accurate driver’s insurance quote. - Compare Your Options:

Look carefully at the details:- Premiums

- Deductibles

- Discounts and special offers

- Ask for Clarification:

If any term or condition isn’t clear, don’t hesitate to reach out to the insurer for an explanation. - Review the Terms:

Carefully read the policy details before making your decision. Sometimes, the cheapest quote may lack necessary coverage. - Finalize Your Decision:

Choose the policy that provides a balance between cost and coverage quality, then complete the application online or over the phone.

Quick Tip

Before making your final decision, write down any questions you might have and call the insurer to clear any doubts. This direct communication can sometimes reveal hidden discounts or special offers that aren’t widely advertised.

Car Insurance Comparison Online Made Simple: Benefits of Comparing Car Insurance Quotes Online

Online car insurance comparison offers several benefits:

- Time-Saving:

No need for endless phone calls; instantly view multiple quotes. - Cost-Efficient:

It helps you find cheap driving insurance without wasting money on unnecessary features. - Transparency:

Online tools allow a clear comparison of coverage, deductibles, and premiums. - User-Friendly:

Many platforms offer intuitive interfaces to help you quickly navigate and compare options.

- Bullet Point Summary:

- Use trusted comparison tools

- Gather all required personal information

- Compare key factors like coverage, deductibles, and discounts

- Read reviews and verify customer satisfaction

- Finalize your choice with direct confirmation from the insurer

ℹ️ Did You Know?

Studies indicate that drivers who compare car insurance quotes online save an average of 15% on their premiums compared to those who do not shop around.

Insider Tips for Finding Cheap Driving Insurance

Finding cheap driving insurance that provides ample protection is a smart and necessary financial step. Here are some insider tips that can help:

Tips for Lowering Your Insurance Rate

- Maintain a Clean Record:

Avoid traffic violations and accidents. A spotless driving record is your best asset. - Opt for a Higher Deductible:

Increasing your deductible can lower your premium, but balance this with your ability to pay out-of-pocket in an emergency.Pro Tip!

Increasing your deductible to $1,000 can reduce your premium by up to 20%.

- Utilize Discounts:

Ask about safe driver discounts, multi-policy discounts, and even discounts for completing defensive driving courses. - Review Your Coverage Annually:

Life changes – like moving to a less risky area or switching vehicles – can significantly affect your rate. - Drive a Modest Car:

Sporty cars are appealing but often costly to insure. Consider vehicles that are cheaper to repair and less likely to be stolen. - Limit Mileage:

If you drive less, let the insurer know. Lower annual mileage usually translates to lower premiums.

Quick Tip

Regularly update your insurance provider with any changes in your driving habits or vehicle usage. This can ensure you continue receiving the best possible rate for your current situation.

Key Considerations for Drivers’ Insurance Quote

When you request a driver’s insurance quote, make sure you ask about:

- Bundled Discounts: Savings when combining policies.

- Usage-Based Insurance: Some providers offer lower rates if you have a good driving score recorded via telematics.

- Loyalty Rewards: Check if your insurer rewards long-term customers with premium reductions.

- Bullet Point Recap:

- Keep your driving history clean

- Consider a higher deductible for lower premiums

- Always inquire about available discounts

- Adjust your policy annually

- Choose vehicles with lower repair and theft costs

- Inform your insurer of lower mileage for additional savings

Advanced Strategies and Best Practices

Once you’ve mastered the basics of obtaining car insurance quotes, it pays to dive into advanced strategies that can further optimize your savings and coverage benefits.

Negotiating Better Rates

- Be Honest But Inquisitive:

When speaking directly with an agent, explain your situation clearly. Ask if there are any special discounts or adjustments that you might have missed online. - Compare and Leverage Offers:

If you receive a competitive quote, use it as leverage. Mention it to your current provider; they might match or beat the offer to keep you as a customer.

Bundling and Additional Discounts

- Bundle Your Policies:

Combining auto, home, or renters insurance with the same provider could unlock substantial savings. Most insurers offer attractive bundle pricing. - Credit-Based Insurance Score:

Keep an eye on your credit score as it can influence your premium. Improving your score over time might lead to a lower rate on future quotes. - Ask About Special Programs:

Some insurers offer programs for students, veterans, or low-mileage drivers that are not widely advertised. Always ask if you qualify.

The Importance of Full Coverage vs. Bare-Bones

- Evaluate Your Needs:

Sometimes, the cheapest vehicle insurance might not include all the protections you require. The key is balancing affordability with the coverage level that protects your financial interests. - Risk Assessment:

Consider the risk factors specific to your lifestyle and vehicle usage before opting for minimal coverage. It is better to have adequate coverage in the event of an accident than to regret being underinsured. - Bullet Point Essentials:

- Compare negotiation tactics

- Leverage competitive offers for rate adjustments

- Bundle your policies for discounts

- Assess your full coverage needs

- Maintain and improve your credit score

Average Annual Full Coverage Car Insurance Costs by State (2024)

| State | Average Annual Cost |

| Alabama | $1,809 |

| Alaska | $2,323 |

| Arizona | $1,696 |

| Arkansas | $2,061 |

| California | $2,462 |

| Colorado | $2,489 |

| Connecticut | $1,730 |

| Delaware | $2,462 |

| Florida | $4,326 |

| Georgia | $2,181 |

| Hawaii | $1,633 |

| Idaho | $1,021 |

| Illinois | $2,345 |

| Indiana | $1,454 |

| Iowa | $1,238 |

| Kansas | $1,693 |

| Kentucky | $1,979 |

| Louisiana | $3,629 |

| Maine | $1,216 |

| Maryland | $3,349 |

| Massachusetts | $2,333 |

| Michigan | $2,995 |

| Minnesota | $2,360 |

| Mississippi | $1,704 |

| Missouri | $2,323 |

| Montana | $1,770 |

| Nebraska | $1,538 |

| Nevada | $3,342 |

| New Hampshire | $1,411 |

| New Jersey | $2,240 |

| New Mexico | $2,104 |

| New York | $4,769 |

| North Carolina | $1,307 |

| North Dakota | $1,319 |

| Ohio | $1,112 |

| Oklahoma | $2,291 |

| Oregon | $1,459 |

| Pennsylvania | $3,600 |

| Rhode Island | $2,715 |

| South Carolina | $2,387 |

| South Dakota | $1,821 |

| Tennessee | $1,720 |

| Texas | $2,938 |

| Utah | $1,955 |

| Vermont | $1,037 |

| Virginia | $1,486 |

| Washington | $1,829 |

| West Virginia | $1,688 |

| Wisconsin | $1,905 |

| Wyoming | $1,341 |

Source: CNN Underscored Money

ℹ️ Did You Know?

Drivers in NY pay the highest average monthly car insurance rates at $397, which is 138% higher than the national average.

Average 6-Month Full Coverage Car Insurance Premiums by Company (2024)

| Insurance Provider | Average 6-Month Premium |

| USAA | $863 |

| GEICO | $936 |

| State Farm | $1,045 |

| Nationwide | $982 |

| Progressive | $1,224 |

| Farmers | $1,139 |

| Allstate | $1,542 |

| American Family | $949 |

| Travelers | $926 |

| Liberty Mutual | $751 |

Note: Premiums can vary based on factors such as driving history, location, credit score, and vehicle type. Readers should obtain personalized quotes to determine the most accurate rates for their specific circumstances.

Related Guides:

Average Car Insurance Cost: The Ultimate Research

Frequently Asked Questions (FAQs)

What exactly are car insurance quotes?

Car insurance quotes are estimates that tell you what you might pay for a car insurance policy based on your individual details. They are preliminary figures that allow you to compare different coverage options.

How can I get cheap car insurance quotes?

To get cheap car insurance quotes, compare multiple providers online, ask for discounts, maintain a clean driving record, and consider increasing your deductible. Use online tools to compare car insurance quotations side by side.

What is the difference between a drivers insurance quote and car insurance quotations?

Although the terms are often used interchangeably, a drivers insurance quote typically refers to an estimate provided specifically based on individual driver details, while car insurance quotations might also cover varying coverage types and add-ons.

How do I ensure I get affordable auto insurance quotes?

Make sure you provide accurate and up-to-date information, shop around online using comparison tools, verify discounts, and speak with insurance representatives to ensure that the quote reflects all possible savings.

What should I do if the cheapest vehicle insurance does not include crucial coverage?

It is important to balance cost with adequate coverage. If the cheapest option is lacking key protections, consider paying a little more for a policy that truly meets your needs.

Are there any specific strategies for cheap driving insurance?

Absolutely. Maintaining a good driving record, lowering your mileage, and asking about usage-based programs are all excellent strategies for securing cheap driving insurance without compromising on coverage.

What is the average cost of car insurance in 2025?

The national average annual cost for full coverage car insurance is $2,312, while minimum coverage averages $625.

Which states have the cheapest car insurance rates?

Wyoming, Vermont, and New Hampshire offer some of the lowest full coverage car insurance rates in the country.

How Long Does it Take to Get a Car Insurance Quote?

Getting one car insurance quote shouldn’t take more than 1-2 minutes; sometimes, it depends on the application’s specifications.

Do Car Insurance Quotes Affect Your Credit Score?

Car Insurance quotes do not affect, nor hurt, your credit score. However, every time car insurance companies run your credit report to give you their free quotes, an inquiry is added to your credit report, but it does not affect your score.

Does Your Credit Score Affect Your Car Insurance?

92% of insurers now consider credit when determining auto insurance quotes. If you have an excellent credit score, you will get a lower quote on car insurance than a driver with a bad credit score.

Don’t Let Insurance Drive You Bananas!

When you set out to compare car insurance quotes, it is not just about finding the lowest price – it is about ensuring that the protection you purchase truly fits your needs. From understanding the basics of an auto insurance quote comparison to delving into advanced techniques like bundling and negotiation, this guide has covered every angle.

By following the step-by-step advice, using comparison tools wisely, and asking the right questions, you can confidently secure cheap car insurance quotes that work in your favor. Keep in mind that auto insurance is a personal investment in your future security, and taking the time to get it right is well worth the effort.

ℹ️ Did You Know?

Consumers who regularly review and update their auto insurance policies can save up to 20% per year on premiums. Switching insurance providers can save drivers a median of $461 annually, with many saving at least $100.

Remember, the journey to affordable and reliable car insurance coverage begins with being an informed shopper. Bookmark this guide and refer back whenever you need to compare car insurance quotes online, or simply want to check if you’re still getting the best deal.

With this comprehensive resource in hand, you’re now prepared to navigate the complexities of auto insurance with confidence and clarity. Whether you’re hunting for cheap car insurance quotes, comparing different policies, or just seeking expert advice on getting the cheapest vehicle insurance, you have all the tools you need to make an informed decision. Enjoy the journey towards smarter, more cost-effective coverage!

This guide is intended to provide practical advice and actionable strategies based on current trends and common questions surrounding car insurance. By following these guidelines, you can ensure that every car insurance quote you receive is measured not just by cost, but by the quality and security it offers you and your loved ones.

Ready to get started? Click the button below to receive your personalized car insurance quotes and take charge of your savings!

Get all the best quotes from leading providers in a click of a button!