Some of the products on this page come from partners who may compensate us when you click on their links or take specific actions. This helps us keep our content free. That said, our opinions are our own and based on independent analysis.

Shopping for life insurance is one of the most important decisions you’ll make for your family’s financial future. But let’s face it, navigating quotes, coverage types, and fine print can feel like learning a new language. This guide breaks it all down in plain English so you can confidently compare life insurance quotes, understand what you’re buying, and avoid overpaying.

Key Takeaways

- Life insurance pricing varies by 50% or more between companies, so compare at least five quotes to get the best rate.

- Term life is the most affordable option for young families, but permanent life builds cash value over time.

- Factors like health, age, occupation, and lifestyle choices (yes, your hobbies matter) can swing your rates dramatically.

- Many consumers leave money on the table by skipping annual reviews to find better rates as their health improves or life circumstances change.

- Quotes can be generated online in under 10 minutes, but skipping a licensed agent can leave you underinsured or paying too much.

- Recent industry data shows the average term life policy premium is now $36/month for a healthy 35-year-old which is up from $30/month a few years ago due to inflation and mortality table adjustments.

What is Life Insurance?

Simply put, life insurance is a contract between an insurance company and a policyholder. The policyholder pays a premium, and the life insurance company pays a specific amount of money to the selected beneficiaries, usually family members, upon the policyholder’s death.

Life insurance can also take care of your debts, like tuition fees, medical debts, mortgage, and personal loans.

Different Types of Policies Offered by Good Life Insurance Companies

There are different types of insurance policy plans. But the main types of life insurance are term life insurance vs whole life insurance (also called permanent life insurance).

Here we go:

Term Life Insurance

Term life insurance covers a limited period, which can be 10, 20, or 30 years; some life insurance companies even offer coverage for up to 35 or 40 years. If the policyholder dies during the stated term, the beneficiaries receive the agreed amount of money for their upkeep and other family expenses. Upon expiring, you can renew it, change it into a permanent policy, or terminate it.

Whole Life Insurance

Whole life insurance is a general name for life insurance policies that never expire. This is why they are often referred to as Permanent Life Insurance. This type of plan is quite costly. However, it offers extra benefits like cash value. The savings can be loaned against the policy when you need cash.

Within these two broad classes of life insurance policies, there are these subcategories to choose from:

- Universal life insurance

- Variable life insurance

- Variable universal life insurance and others

Universal Life Insurance

Like a whole life insurance policy, universal life insurance has a cash value. The premiums you pay will go towards both that value and the death benefit.

The key with universal life insurance is that policyholders can alter both the premium and the death benefit amount within the same policy.

Variable Life Insurance

A variable life insurance cash value is more like an investment. The money you pay goes into multiple mutual fund-like accounts that will grow over time.

However, this carries a risk as you can lose money if the market enters recession. The value of your policy lies in the value of the stock market.

Simplified Issue Life Insurance

Simplified Issue life insurance is a type of plan with a “no-exam policy.” Instead of the exam, your risk would be determined through a health questionnaire.

This “no exam policy” mainly benefits healthy individuals looking to purchase a plan quickly. Unfortunately, people in poor health may still be subjected to a medical exam and be denied an insurance plan.

But if you would like to know the average cost of life insurance at your favorite firm, hop on a call right now.

Get all the best quotes from leading providers in a click of a button!

Other Forms of Life Insurance

Group Life Insurance

Group life insurance covers several different people under one contract, usually found in workplaces.

Mortgage Life Insurance

With mortgage life insurance, the company will cover the remaining balance of your mortgage payments if you pass away. Your beneficiaries will not need to pay the mortgage off.

Credit Life Insurance

Credit life insurance covers any loans you had before your death. If you die, this policy will cover the remaining balance of your loan.

Accidental Death and Dismemberment Insurance

Accidental death insurance and dismemberment insurance will pay you or your beneficiaries a certain amount of money in the event you die or are dismembered due to an accident.

Joint Life Insurance

Joint life insurance insures two people, usually spouses, under one policy. There are two distinct types of joint life insurance:

- First-to-die joint life insurance pays out upon the first person’s death. The surviving member is the beneficiary who receives the lump sum amount to finance their lifestyle.

- Second-to-die joint life insurance pays out after both people have died. The money goes to the couple’s beneficiaries. However, the surviving spouse must continue to pay the premium once the first spouse has passed.

Level Term Life Insurance

Level-term life insurance is a type of term life insurance in which the premium and the death benefit do not change throughout the period of the plan.

Direct Life Insurance

This is a life insurance product in which the buyer does not need to deal with an agent but can work directly with the insurance company.

Why Compare Life Insurance Quotes?

Life insurance isn’t a one-size-fits-all product. Rates vary dramatically depending on your health profile, the insurer’s underwriting rules, and even your ZIP code. Of particular interest here is the insurer’s underwriting rules and appetite for new business. That’s why comparing life insurance quotes is the only reliable way to get the right coverage at the right price.

Key reasons to compare:

- Insurers use different risk algorithms so one may rate your health status more favorably than another.

- Policy riders (add-ons like critical illness or accidental death benefits) can add value but inflate costs if bundled unnecessarily.

- Competition drives pricing so comparing multiple quotes keeps companies honest.

- Underwriting surprises happen: one carrier may require a paramedical exam; another may waive it based on your history.

How to Compare Life Insurance Quotes Like a Pro

When you’re looking for life insurance, follow these simple steps to make the most out of the quotes you receive.

- Choose Your Policy Type: Decide between term life (temporary coverage, cheaper) and permanent life (lifelong protection with a cash value component).

- Calculate Your Coverage Needs: A common rule of thumb is 10–15 times your annual income, but don’t forget future costs like college or medical bills.

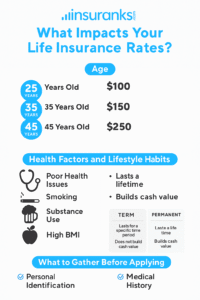

- Gather Personal Details: Insurers will need your age, height, weight, smoking status, medications, health conditions, and family history.

- Get Multiple Quotes Simultaneously: Use online marketplaces or work with an independent agent to get at least five quotes side by side.

- Examine the Fine Print: Look at renewal guarantees, conversion options (term to permanent), and exclusions for risky hobbies.

- Check Company Financial Strength: A high AM Best rating means the insurer is more likely to be around when your beneficiaries need it.

Factors That Affect Your Life Insurance Quotes

When determining eligibility and premiums, insurers will consider a number of factors. Rates can fall onto “Tables” that correspond to the applicant’s health. So, two people who are the same age may end up paying very different rates for the same policy, depending on their health. To determine their health, insurers will look at the following points of data.

- Age: The younger you are, the cheaper your policy.

- Gender: Women typically pay less due to longer life expectancy.

- Health: High cholesterol, hypertension, or a recent cancer history will increase premiums.

- Lifestyle Choices: Tobacco use or high-risk hobbies like skydiving can double or triple your rates.

- Occupation: Jobs like logging, mining, or commercial fishing often come with higher premiums.

- Driving Record: Multiple moving violations or a DUI can impact rates.

- Policy Term & Amount: Longer terms and higher death benefits cost more.

Mistakes to Avoid When Comparing Life Insurance Quotes

- Buying on price alone: The cheapest policy isn’t always the best so the insurer reputation and policy features matter.

- Underinsuring: Too many people pick $100k policies when they really need $500k+.

- Skipping riders: If your family history includes critical illnesses, a rider could make a big difference.

- Not reviewing policies regularly: Life changes like marriage, kids, or new debts mean your insurance should adapt too.

- Letting your term expire without converting: This leaves you scrambling for new coverage when you’re older and premiums skyrocket.

How to Lock in the Best Life Insurance Rates

Once you’ve compared quotes and chosen the right policy type, timing is everything. Many buyers don’t realize how small changes in health, age, or even market conditions can affect premiums. Locking in the best rate means acting strategically and taking advantage of your current health status, understanding how insurers price policies, and choosing payment options that save money over time.

- Apply when you’re healthy so that you’ll never be younger or healthier than today.

- Don’t delay after comparing quotes because rates can change with age or new health issues.

- Consider annual premium payments, which are often cheaper than monthly plans.

- Bundle life with disability or other products for potential multi-policy discounts.

- Work with an independent agent who can shop dozens of carriers instead of being locked into one company.

Best Life Insurance Companies & Services

Here are our top recommended life insurance companies:

Fabric: 5/5

Fabric is a fully online term life insurance company that offers fast, easy online term life and accidental death insurance at affordable rates to its shoppers.

You can find $100k to $5m policies with 10, 15, and 20-year terms starting from as little as $6 a month and get covered in less than 10 minutes with no brokers, no agents, no medical exam.

Ethos: 4.5/5

Ethos is a modern, advanced life insurance company offering a broad range of term life insurance policies, from 10 to 30 years in length, at affordable prices and flexible online policies. The firm offers fast and smooth online applications.

Everyday Life Insurance: 4.5/5

Everyday Life Insurance is a reliable life insurance company that distinguishes itself by offering exceptional customer service and great financial stability.

Northwestern Mutual Life Insurance: 4.5/5

Northwestern Mutual is known for its flexibility. They offer five different types of plans, and these plans are either whole life, term, or universal life policies.

At any point, a term life policy can become a whole life policy without you going in for a medical exam.

Prudential Life Insurance: 4/5

Prudential is known for its high coverage limit and its customizability. Though they do NOT offer whole life insurance policies, the firm has three variable policies, namely:

- PruLife Custom Premier II Permanent Variable Universal Life

- VUL Protector Permanent Variable Universal Life

- PruLife SVUL ProtectorSM Permanent Variable Universal Life.

One complaint with Prudential is that you must work with their agent to ensure you fully understand their plans.

State Farm Life Insurance: 4/5

State Farm is another famous company whose premiums are typically higher than average, and they have few term-length options. Notably, they are known for their stability and reliable customer service, but aren’t one of the cheapest life insurance providers.

Get all the best quotes from leading providers in a click of a button!

Don’t Leave Your Family’s Future to Chance

Life insurance isn’t a luxury: it’s a foundational financial tool to protect the people you love. Comparing quotes is the key step to avoid overpaying and to get the coverage you truly need.

Remember: policies are more expensive the longer you wait, so start today.